Brazilian Real, Stocks Rally as Traders Root for Impeachment

This article from Bloomberg may be of interest to subscribers. Here is a section:

"Brazilian stocks have already risen a lot these past days as investors reverted bets on the worsening of the economy," said Alvaro Bandeira, economist at Banco Modal.

"The market clearly wants a better government, one that’s credible and stable, and able to change economic policies that have led the country into this recession."

Some market watchers warned the rally could be short-lived as the process to impeach the president drags on, potentially plunging Brazil deeper into chaos.“The market is reacting like Brazil woke up today as a whole new country, but a corruption investigation is hard, long and full of surprises," said Adeodato Volpi Netto, head of capital markets at Eleven Financial Research. "There’s room for profit taking on stocks as short-term investors play to make money, not to discuss politics."

I had hoped Dilma Rousseff would lose the 2014 election but that was not to be the case and her success resulted in a loss of investor confidence that Brazil could deal effectively with its challenges. The collapse of oil prices highlighted how much of a piggy bank Petrobras had become for the ruling elite and pictures today of former, and well-loved, president Lula da Silva being arrested highlight just how high up the payments may have gone. As the above segment suggests impeachment is not a simple process so we can expect this saga to persist a while longer unless of course she resigns which appears unlikely given the protections from prosecution afforded the president.

The Brazil stock market is garnering attention because of this news story but the rebound in industrial resources and energy prices is an additional bullish consideration that should also help to support the currency which has been among the weakest in the world.

The Dollar has now unwound its oversold condition relative to the 200-day MA and will need to fall through today’s low near BRL3.7 to break the medium-term progression of higher reaction lows and signal a return to Real dominance.

The iBovespa Index extended its rally today to test the psychological 50,000 level before easing. Some consolidation in this area is likely. This is not the first reversionary rally the Brazilian market has staged and it will need to hold the region of the trend mean on the first significant pullback to demonstrate a return to demand dominance beyond short covering.

Following a 94% decline Vale has now unwound its oversold condition relative to the 200-day MA. Some consolidation is likely at this stage and it will need to sustain a move back above the trend mean to confirm a change of trend.

Petroleo Brasileiro has a similar pattern and has also unwound an oversold condition relative to the trend mean. .png)

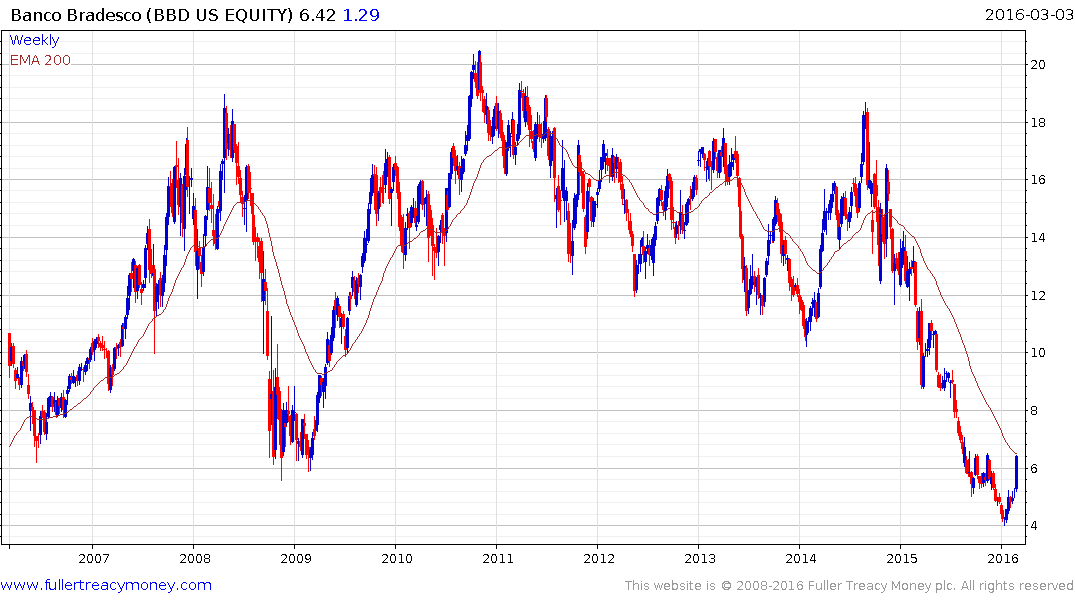

Banco Bradesco has now pushed above its trend mean and will need to hold the majority of the bounce to confirm more than temporary support has been found.

The potential for a change of administration in Brazil could have profound consequences for the nation’s assets markets so this is worth monitoring.