Crude Rises as OPEC Secretary General Says Group May Cut Target

This article by Mark Shenk for Bloomberg may be of interest to subscribers. Here is a section:

“I am not really concerned about the prices declining at this short term,” OPEC’s El-Badri said. “I think the price will rebound by the end of the year. When we’re coming to the fall, things will look better.”

Saudi Arabia cut its crude production by 408,000 barrels a day to 9.6 million in August, the biggest reduction since the end of 2012, the kingdom said in a submission to OPEC.

OPEC officials, including Saudi Arabian Oil Minister Ali Al-Naimi, have said they see no urgent need to respond to oil’s drop. Prices “always fluctuate and this is normal,” Al-Naimi told reporters in Kuwait on Sept. 11. Oil will recover as demand for winter fuels climbs, Kuwaiti Oil Minister Ali Al-Omair said the same day. The group is next due to meet on Nov. 27.

‘Huge Decline’

“The huge decline in prices since June has been a major concern to all oil producers,” John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy, said by phone. “The Saudis have already started to cut output and now we’re getting evidence of further action. The market appears to have found a bottom and the statements are a sign for the buyers to return.”Russian and OPEC analysts will meet in the spring, Russian Energy Ministry spokeswoman Olga Golant said by text message. “High-level” talks are scheduled for the second half of 2015, according to a joint statement from OPEC and Russia today “I wouldn’t be surprised if the Russians and OPEC cooperated to support the market,” Bill O’Grady, chief market strategist at Confluence Investment Management in St. Louis, which oversees $2.6 billion, said by phone. “It’s in the interests of both parties to keep prices from falling further.”

Oil remains both the most important and most political of all commodities. The actions of OPEC, in supporting prices in the $100 region over the last three-years, have helped sustain the range evident in Brent crude prices. As a result traders have been waiting for a statement from the cartel on what their actions are likely to be with prices testing the lower side. They appear to have their answer.

Brent Crude is now unwinding a short-term oversold condition and a sustained move below $96 would be required to question current scope for some additional steadying from this area. West Texas Intermediate posted a similar upward dynamic today.

Oil shares which have been pulling back recently also firmed today. Royal Dutch Shell (Est P/E 10.62, DY 4.46%) found support in the region of the 200-day MA yesterday.

Petrobras (Est P/E 11.43, DY 4.45%) is also rallying from the region of its MA.

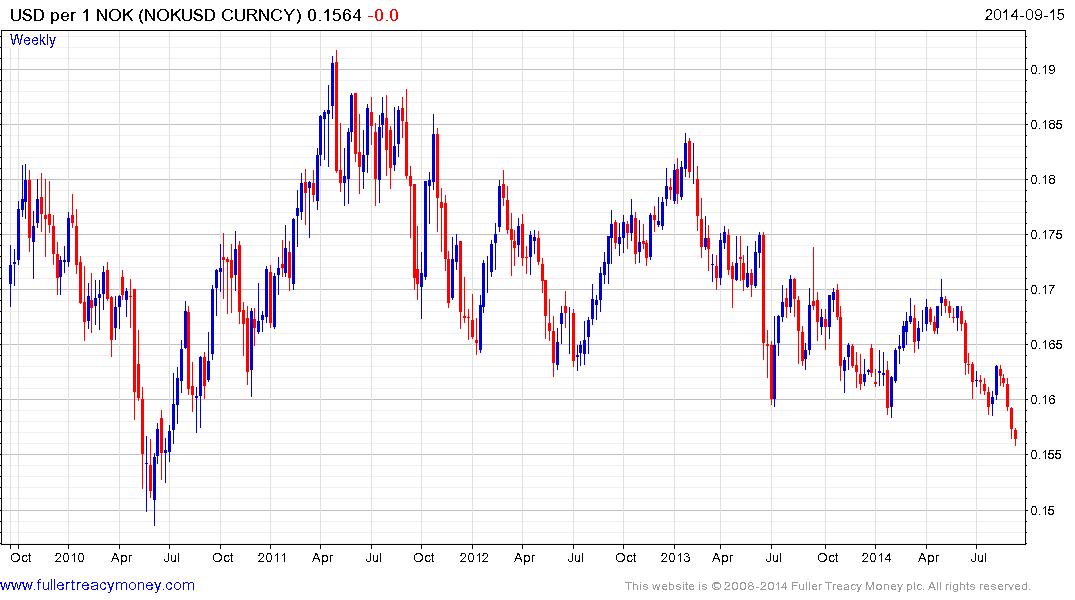

Norway might have one of the most impressive balance sheets of any Western country and an overnight deposit rate of 2.5% but the Krone tends to trade in line with oil prices. Today’s action in the oil market has not been enough to stem selling pressure but some additional follow through would likely begin to put pressure on Krone shorts.

Subsea 7 (Est P/E 7.23, DY 3.92%), which is a pure-play on offshore oil services, also has a similar pattern to the oil price and exhibits a short-term oversold condition.