Shale Profits Finally Blossoming After Decade of Steep Losses

This article from Bloomberg may be of interest to subscribers. Here is a section:

US shale drillers are expected to post record second-quarter profits in coming days, reversing nearly a decade of debt-fueled losses.

The top 28 publicly traded US independent oil producers generated $25.5 billion in free cash flow in the three months to June 30, according to estimates compiled by Bloomberg. In that space of time they’ll have made enough cash to erase one-fourth of what they lost over the previous decade.

Fracking revolutionized global energy markets by enabling American drillers to harvest shale resources that had previously been untouchable. In the space of just over 10 years, the US went from a declining crude producer to the world’s dominant oil and gas source, but at an astronomical cost: the 28 companies lost about $115 billion in the decade leading up to the Covid-19 pandemic.

Nothing about unconventional supply is cheap but it is a lot more cost effective than it used to be. The continual need for drilling and the quick abundant payback initially led to excessive enthusiasm. The business model has more recently evolved to be more sensitive to the cost of production, oil prices and economies of scale. That has finally translated into profits for the sector.

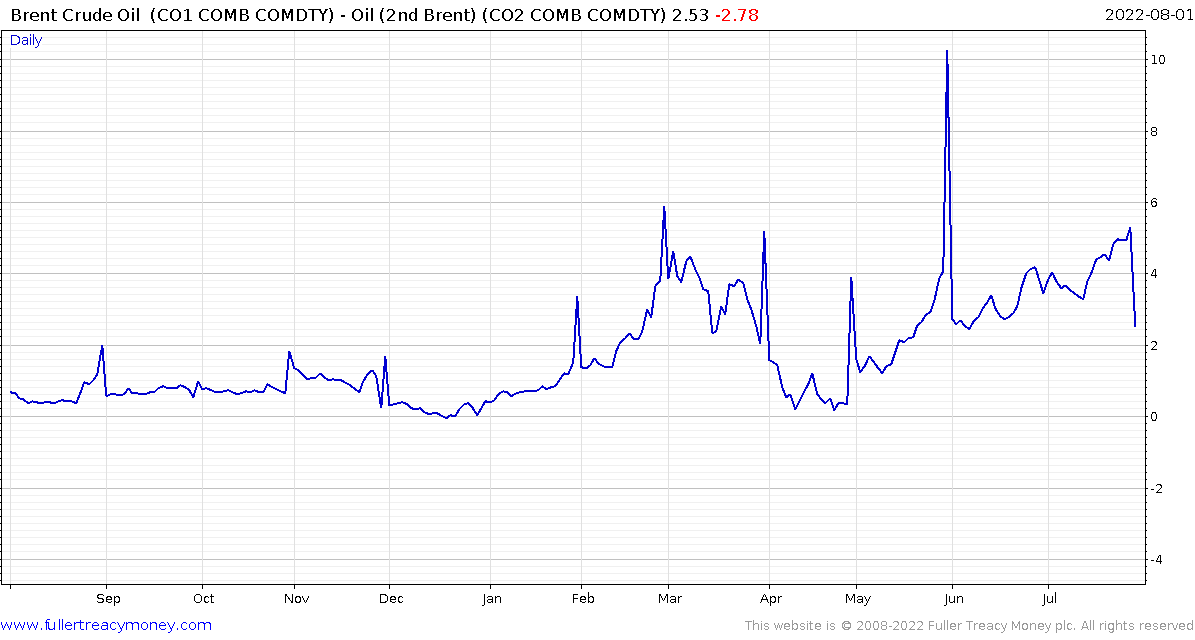

The backwardation between the front and second month contracts contracted sharply today suggests the multi-month supply deficit is easing. As Saudi Arabia and Abu Dhabi increase supply there is potential for oil prices to surprise on the downside.

The backwardation between the front and second month contracts contracted sharply today suggests the multi-month supply deficit is easing. As Saudi Arabia and Abu Dhabi increase supply there is potential for oil prices to surprise on the downside.

The Oil SPDR bounced impressively from the region of the trend mean last week but now needs to hold the gain.

The Oil SPDR bounced impressively from the region of the trend mean last week but now needs to hold the gain.