A step change for Sibanye

This article by Warren Dick for Mineweb may be of interest to subscribers. Here is a section:

The yawning margins South Africa’s gold producers are now enjoying courtesy of the current rand-dollar exchange rate and gold price are bringing a whole lot of positive problems that revolve around what to do with the cash.

?“A situation like this only comes around once or twice in a lifetime,” is the way Sibanye CEO Neal Froneman put it in our interview. To add numbers for context: Sibanye has guided the market that it will produce 50 000 kilograms of gold in 2016 (the company’s financial year runs to the end of December). The current rand gold price means that Sibanye will earn R612 000/kg, whereas forecast All-in Sustaining Cost (AISC) is expected to be R425 000/kg. Should these assumptions hold, it would indicate the margin of R187 000/kg would generate earnings before interest and tax of R9.35 billion, with cash flow from operations in that region. This massive increase in potential free cash flow explains why Sibanye’s share price has risen 182% in the last three months.

So what will it do with the cash?

This year it will have to pay for the acquisition of Aquarius Platinum and the Rustenburg Operations from Amplats which amounts to about R6 billion. Using existing cash resources and debt facilities means the company would only marginally breach its self-imposed comfort level of debt to operating profit without factoring in the windfall from the margins it would enjoy during the course of the year.

David has long said that happiness in the currency markets is about having both the trend and the central bank on your side. Gold is a monetary metal and its supply does not depend on a central bank. However since no currency can be valued in isolation the influence of whatever central bank is issuing the currency you want to denominate gold in is important. The Dollar has been strong over the last year which has held back gold’s advance against the greenback. On the other hand, the Rand has been among the weakest currencies, so gold has been hitting new all-time highs against it.

.png)

Gold’s underperformance in US Dollar terms ended earlier this month. Gold shares are responding because for the first time in a decade they are now offering leverage to the gold price. The reason they can achieve this is because gold miners have been through a lengthy process of rationalisation where all but the most essential costs have been cut to the bone. Sibanye is one a new breed of gold miner that concentrates of dividends and the share has been rewarded with significant outperformance.

It is somewhat overbought in the short-term, but a sustained move below the trend mean would be required to begin to question medium-term upside potential.

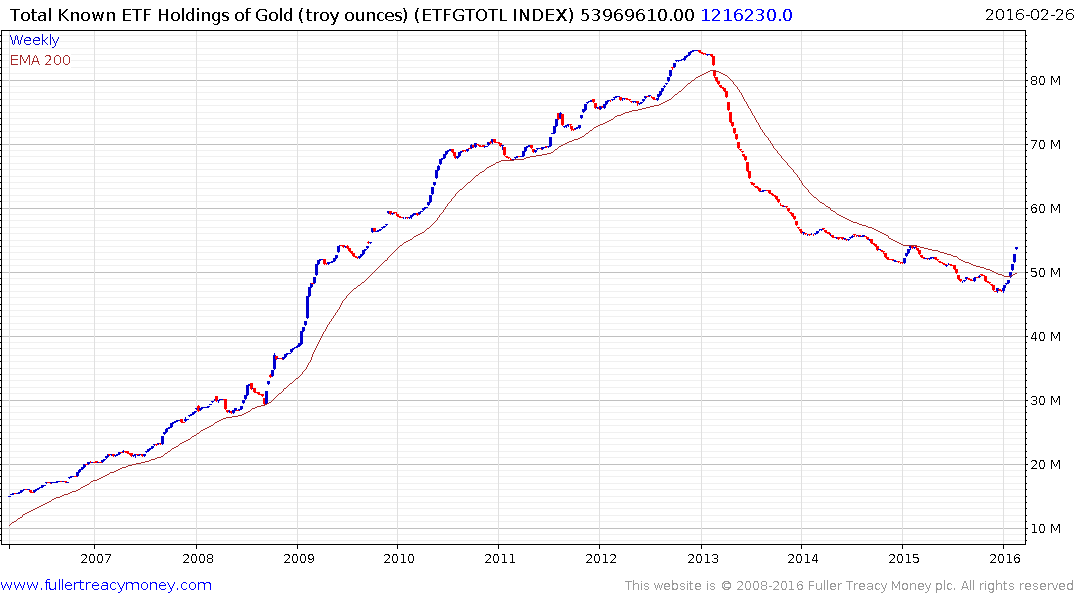

ETF Holdings of Gold which had trended consistently lower over the last four years have also rallied to break the downtrend suggesting broad based support for prices within what continues to look like the first consolidation following a major break the medium-term downtrend.

I received this email today which raises a personal question:

Would you buy gold at the current levels based on your latest chart reading?

I sold the last of my precious metals positions last week because I expect some additional consolidation. I anticipate reopening at least some of them should a favourable opportunity present itself.