Abenomics Skepticism Grows as Price Gauge Retreats

This article by Mariko Ishikawa, Yumi Ikeda and Kevin Buckland for Bloomberg may be of interest to subscribers. Here is a section:

Abe needs to push through structural reforms to spur the world’s third-largest economy, Fitch Ratings said in a report last week, after gross domestic product shrank the most in three years last quarter. Japan isn’t alone in facing reduced inflation expectations as stagnant wages in countries from the U.S. to Germany and Australia threaten to slow economic growth.

?

“Japan’s economy has taken a severe knock which, inevitably, calls into question the credibility of the government’s reflationary program,” Nicholas Spiro, managing director at Spiro Sovereign Strategy in London, said in an e- mailed response to questions yesterday. “Abenomics is far from dead and buried but it’s increasingly on life support.”GDP plunged an annualized 6.8 percent in the three-months through June, the sharpest contraction since the first quarter of 2011, the Cabinet Office said on Aug. 13. That clouds the government’s plan to raise sales tax next year to 10 percent after a three percentage-point increase in April to 8 percent.

Disapproval Rating

Three-quarters of people said they oppose a further levy, according to a Jiji survey conducted Aug. 7-10. The cabinet’s disapproval rating rose to 35.1 percent, the highest since Abe took office in December 2012.“The ‘Abenomics’ fiscal and monetary stimulus policies have been sufficient to bring Japan out of deflation, but this is proving a double-edged sword as wages are not keeping up with prices,” Fitch, which has an A+ grade on Japanese sovereign debt with a negative outlook, said on Aug. 13. “Sustained real wage contraction would risk tipping Japan back into sluggish growth around or below potential.”

The cost of living in Japan grew at three times the pace of wage increases in June. Core consumer prices excluding fresh food rose 3.3 percent from a year earlier, while average overall monthly earnings gained 1 percent. When the effects of the consumption levy are excluded, inflation stood at 1.3 percent.

As the Japanese administration continues to support quantitative easing, the sales tax hike was necessary in order to ensure the credibility of government finances. JGB yields continue to steadily compress following the initial spike higher in early 2013. This highlights just how fine a line between fostering economic growth, promoting inflation and containing government borrowing costs the country is treading.

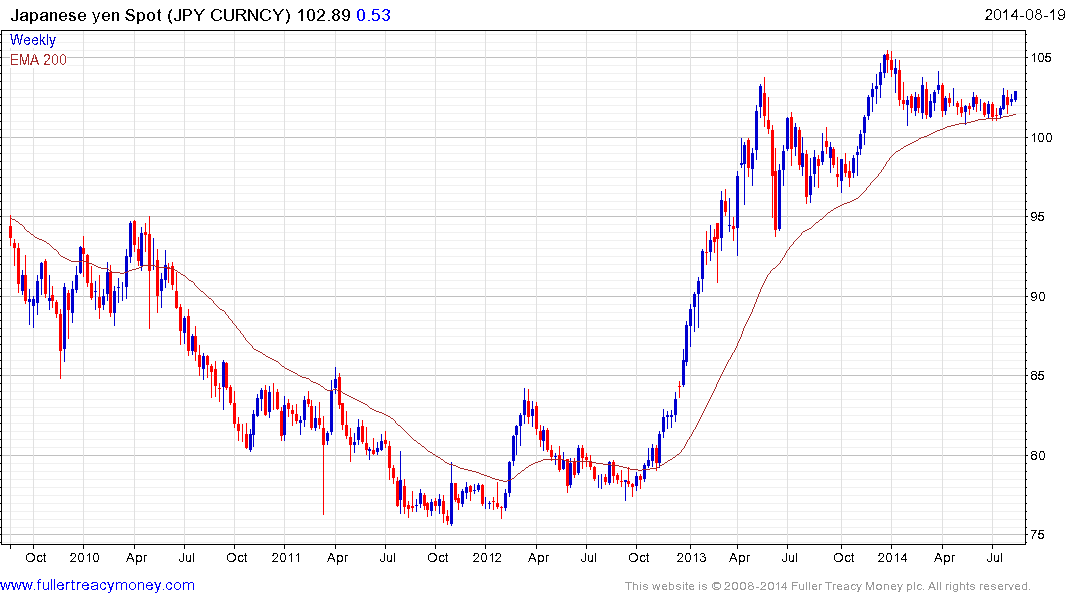

The Dollar has been strengthening against a large basket of currencies, with the notable exception of the Chinese Yuan, but this is of particular note for the Yen. The Dollar continues to firm from the region of the 200-day MA and a sustained move below ¥102 would be required to question medium-term scope for continued upside.

The Nikkei-225 firmed last week from the region of the 200-day MA and has a relatively similar pattern to the Yen.

The Topix 2nd Section Index has not followed through on the weekly key reversal posted in early August and the Index moved to a new closing high today. While still somewhat overbought relative to the trend mean, a clear downward dynamic will be required to check momentum.

The TSE REIT Index pulled back sharply following the early 2013 base breakout but has held a progression of higher reaction lows since and a sustained move below the 200-day MA would be required to question medium-term recovery potential.

Back to top