Aussie as King of Real Yields Seen Halting World's Steepest Drop

This article by Candice Zachariahs for Bloomberg may be of interest to subscribers. Here is a section:

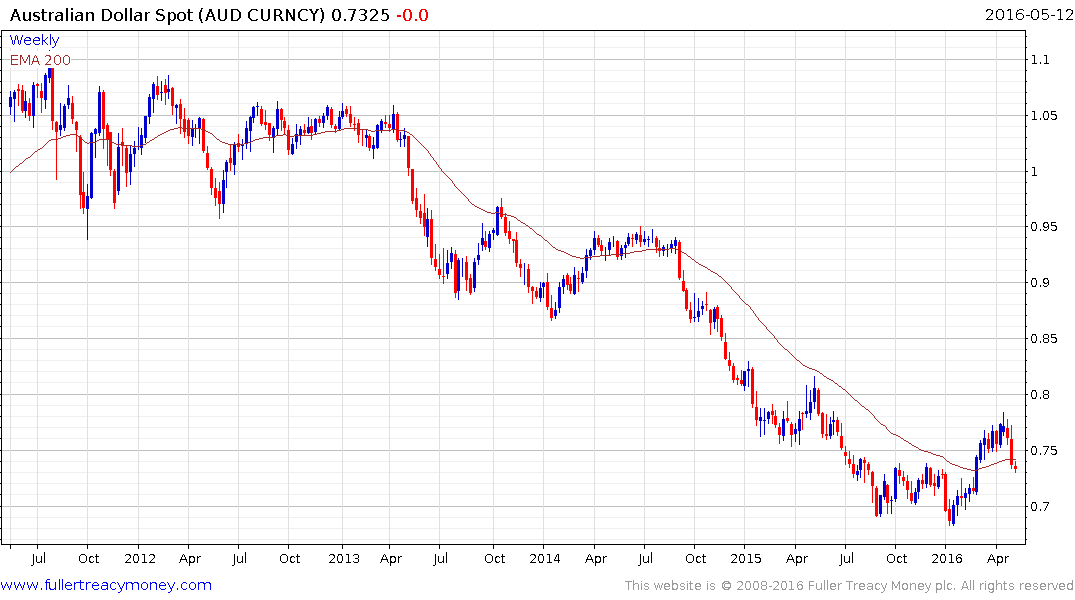

The economy’s underlying resilience helped trip up investors earlier this year when the currency was trading at its weakest in seven years. From a January low of 68.27 cents, the Aussie surged to a 10-month high of 78.35 in April as hedge funds and other large speculators boosted bullish bets.

“When we were sub-70 in January, you couldn’t give the Aussie dollar away, and it was a pretty bitter experience for many to watch the Aussie recover 10 cents from there,” said NAB’s Attrill. “That’s impacted views on the Aussie.”

The past few weeks have been hard on the bulls, with the currency sliding after disappointing price data forced RBA action. Officials said days later that inflation will probably miss the bottom of their target band even with another cut priced into markets.

None of that changes the outlook for the Aussie as external factors tend to dominate domestic developments, said Todd Elmer, a Singapore-based foreign-exchange strategist at Citigroup. The currency’s standing as a higher-yielder as well as Australia’s links to emerging-market growth are likely to be more important in an environment where the Fed’s reluctance to signal higher rates weakens the U.S. dollar, he said.

Even if the RBA cuts interest rates to another historic low, the Australian Dollar will still have a positive carry versus just about every other major currency. For yield hungry investors in a negative interest rate world that will still prove enticing. However interest rates are medium-term considerations while commodity prices tend to be shorter-term arbiters for the Aussie’s outlook.

The Australian Dollar pulled back to unwind its overbought condition relative to the trend mean in line with a similar move in iron-ore prices. With commodity prices steadying the Australian Dollar is testing the region of its 200-day MA. It will need to demonstrate support in this area if potential for additional upside is to be given the benefit of the doubt.

Back to top