Australia's Stevens Posits Whether Policy Has Reached Its Limits

This article by Michael Heath for Bloomberg offers a window on the thinking of a major central banker approaching the end of his tenure so with little to lose. Here is a section:

Australian central bank Governor Glenn Stevens speculated that monetary policy may have reached its limits in spurring economic growth and suggested this could explain why markets are being easily rattled.

“Monetary policy alone hasn’t been, and isn’t, able to generate sustained growth to the extent people desire,” Stevens said in a speech in New York on Tuesday. “Maybe we need to be clearer about what we can’t do. Monetary solutions are for monetary problems. If there are other problems in the underlying working of the economy, central banks won’t be able to solve those.”

?The irony here is that Stevens, who has resisted the global movement to further easing and kept his benchmark rate at 2 percent for almost a year, is facing a currency that has reversed course in the past three months and threatened his push to broaden Australia’s growth drivers. He warned in minutes of this month’s policy meeting Tuesday that the Aussie’s appreciation could complicate efforts to rebalance the economy away from mining.

Stevens, who is in the final months of his 10-year stint at the helm of the Reserve Bank of Australia, also questioned in the notes of his speech whether central banks and their unorthodox policies are solely responsible for the decline in long-term interest rates.

“Monetary policy is not supposed to be able to affect real variables -- like real interest rates -- on a sustained basis,” he said. “Presumably, changes in risk appetite, subdued growth and expectations that growth will continue to be subdued have also played a role in lowering real rates.”

The need for Australia to develop additional sources of economic growth outside the resources sector was a major focus of attention while the price of commodities was falling. With the rebound in energy, industrial resources and soft commodities now underway the urgency of that drive is less pressing. In fact it is likely to act as headwind because the RBA will be less inclined to ease monetary policy when commodities are doing well.

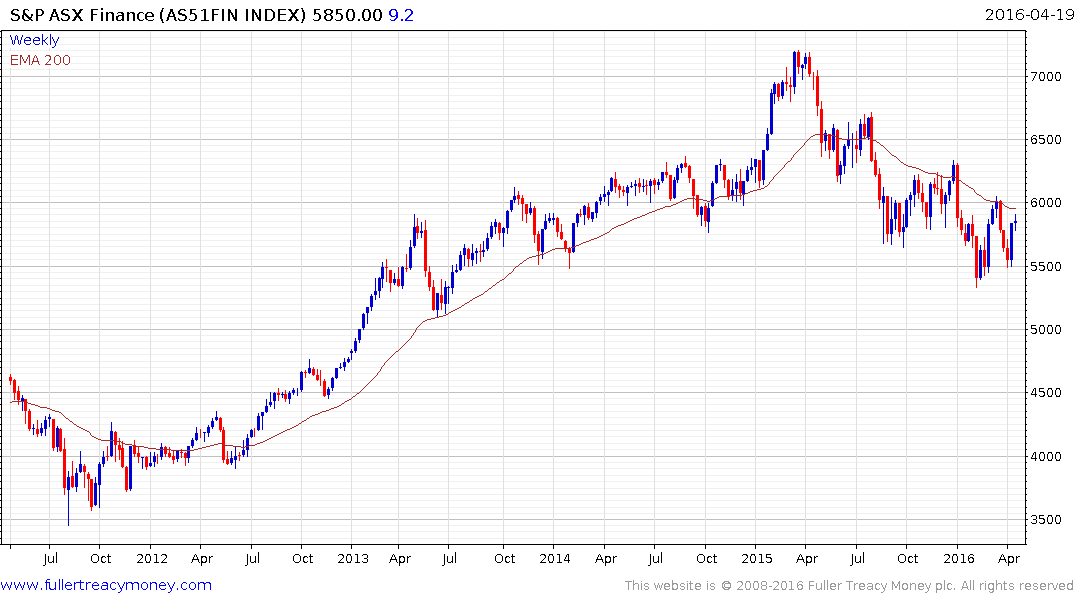

The S&P/ASX 200 is heavily weighted by financials (47%) and that overweight was exaggerated by the relative decline of the materials sector over the last four years. The Financials Index is now back testing the region of its 200-day MA, but will need to sustain a move above it to confirm a return to demand dominance beyond the short-term steadying.

The S&P/ASX 300 Resources Index hit a medium-term peak in 2011 and has held a progression of lower major rally highs since, where the region of the MA has offered resistance on a number of occasions. It has staged an impressive rally from the January low and is now pushing above the trend mean. A sustained move below the early April low at 2360 would be required to question current scope for additional upside.

.png)

The S&P/ASX 300 Resources / S&P/ASX Financials Index ratio’s medium-term progression of lower rally highs is still intact and a break in that progression of lower rally highs will be required to signal a return to outperformance by the resources sector.