Brace for Chaos If U.S Expands Airline Laptop Ban

This article by Justin Bachman and Michael Sasso for Bloomberg may be of interest to subscrib ers. Here is a section:

While companies won’t abandon trans-Atlantic trips, an electronics ban may dampen corporate travel when combined with other recent regulations that have made traveling more onerous, said Michael McCormick, executive director of the Global Business Travel Association. When faced with having to part with their computers—potentially putting sensitive corporate information at risk—some companies may tell employees to leave their computers at home.

“I think business travelers would be far more willing to accept a far more rigorous screening at the airport, rather than having to part with their tools when they travel,” McCormick said.

The threat of laptop loss—be it theft, damage, or misplacement as checked luggage—is likely to make some companies consider whether some meetings can be conducted via Skype or other virtual methods, said Andrew Coggins, a management professor at Pace University’s Lubin School of Business. “People don’t want to let their laptops go,” he said.

That may be bad news for airlines who count heavily on business travel for profitability.

Since business travel costs around three times more than an economy seat for what is probably an area twice as large, the potential hit to revenues is considerable. I know for me, I wouldn’t be writing today unless I could have taken my laptop on the plane on Saturday and the question of course will be how do we define a laptop in an era when smartphones are probably more accurately described as phablets. My Microsoft Surface for example has a detachable keyboard and looks for all the world like a large iPhone..

Meanwhile airline stocks responded very favourably to low cost of fuel but pulled back from early last year as oil rebounded. On the other hand the dearth of competition, since there have been relatively few new entrants to the market, means fares are still high. However, it would appear to be only a matter of time before competition increases.

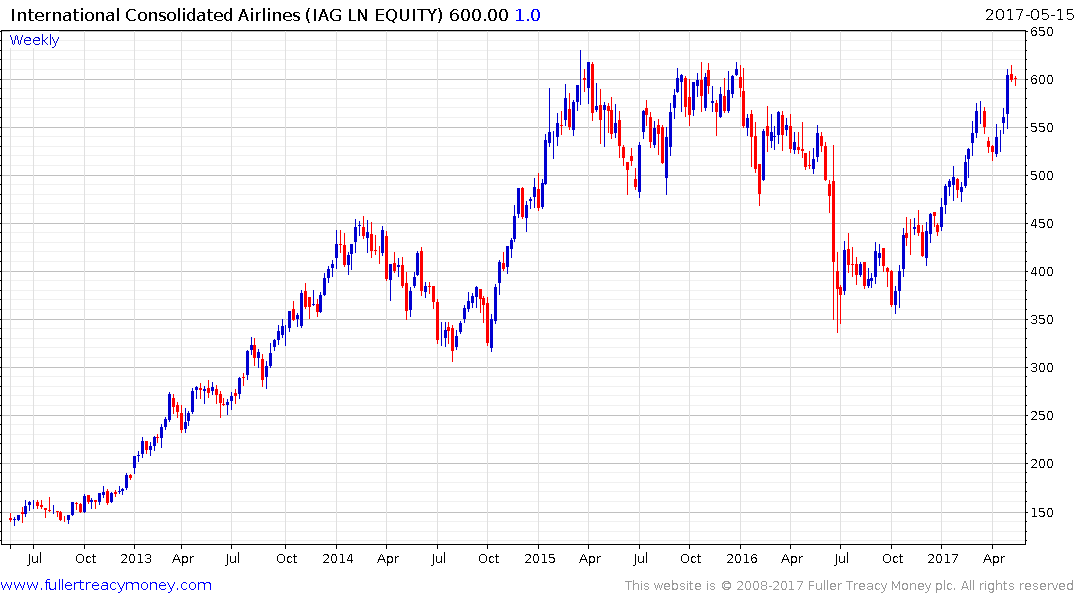

International Consolidated Airlines for example is testing the upper side of a two-year range but will need to sustain a move to new highs to reassert medium-term demand dominance.

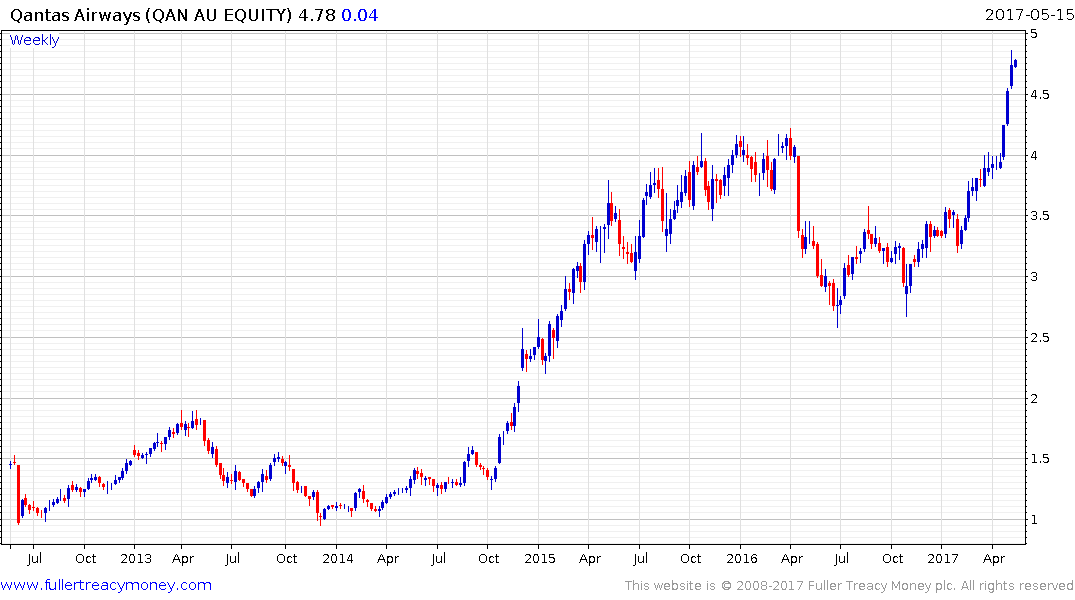

Qantas has been rallying since early this year and broke out to new recovery highs in April. Some consolidation is looking increasingly likely but a sustained more below the trend mean would be required to question potential for additional upside.