California Proposition 61, Drug Price Standards

This article from ballotpedia.org may be of interest to subscribers. Here is a section:

A "yes" vote supports regulating drug prices by requiring state agencies to pay no more than the U.S. Department of Veterans Affairs (VA) pays for prescription drugs.

A "no" vote opposes this measure to require state agencies to pay no more than the VA pays for prescription drugs.

Proposition 61 is the most expensive ballot measure battle in 2016, and could be the ballot measure with the most money spent on it ever in the nation's history, with the combined amount of money raised by the support and opposition campaigns totaling over $125.89 million as of November 2, 2016.

The AIDS Healthcare Foundation, a prominent backer of the campaign supporting Proposition 61, is also backing a drug price standards initiative appearing on the November 2017 ballot in Ohio.

On the way to school yesterday we passed two bill boards one declaring yes was the only way forward and the other saying that to vote no on Proposition 61 was the only moral course of action because it would raise the price of drugs for veterans. My daughters asked what all the fuss is about and after a little digging of course it comes down to money.

The healthcare sector has been more affected by political rhetoric in this presidential campaign than any other. The practice of securing patents, then jacking up prices on existing medications has been repeatedly highlighted in the media. The biotechnology sector, which generally represents where the high cost of developing drugs is reflected by high pricing for new treatments, has been collateral damage in this argument.

Health insurers are leaving the Affordable Care Act exchanges in droves because they cannot make money and consumers are unhappy because their premiums have gone up so much. There is a problem and because it is highly politicised the answer could end up being even more expensive.

In essence the US health system purports to offer a best in class service to anyone who can afford it but seems to ignore the fact that the vast majority of people can get by perfectly well on an average service. Socialised medicine across much of the OECD bears that out and generally has better health outcomes on average than the USA.

Having visited doctor’s offices and talked to a number of my neighbours in the medical professions I notice a much greater willingness to prescribe drugs than in Europe. I fully accept this is a mass generalisation but the culture of “I have a pill for that” seems to be pervasive where there is a much greater focus on a pharmacological answer to problems than to promoting behavioural changes.

Proposition 61, regardless of its merits is an effort to control the price of pharmaceuticals in a market that pays more for drugs than anywhere else. A talk given by Mark Hyman at the Exponential Medicine conference last month set me to thinking about this topic. Nutrigenomics is one of the biggest popular medicine themes right now and in essence is what Herodotus said 2500 years ago. “Let food be thy medicine and medicine be thy food” That’s really bad news for pharmaceutical companies, particularly if it gains wider appeal.

The S&P500 Healthcare Index has lost consistency following an incredibly consistent advance from 2010 and has developing Type-3 top formation characteristics. Established pharmaceutical companies generally have long records of increasing dividends and have benefitted as bond proxies in an era of ultralow rates. That relative advantage is less of a factor if interest rates rise, particularly if dividends do not grow commensurately.

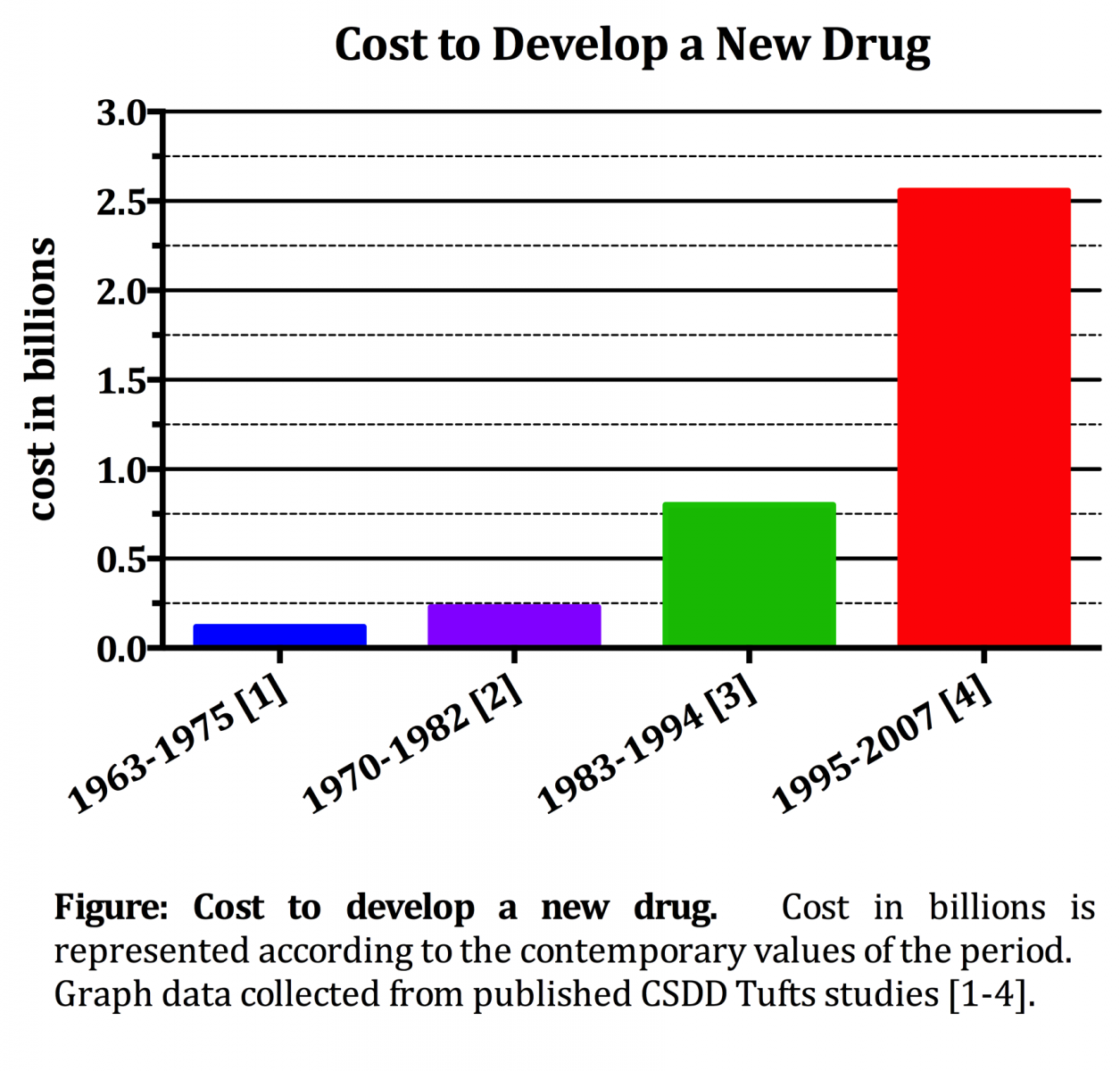

This chart of the rising cost of drug development represents a major headache for the pharmaceutical sector. It means they have to aim for blockbuster drugs that can benefit a large number of people, if they are to have any chance of recouping their investment. If a revolution against higher prices takes hold it potentially represents a considerably headwind for the sector.

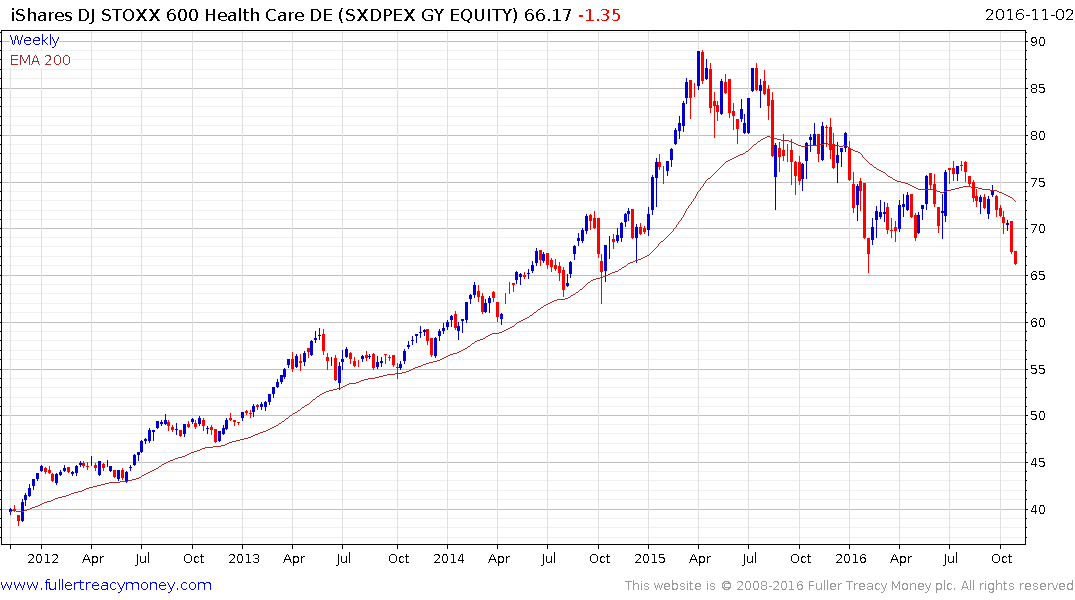

The UK and Euro STOXX healthcare sectors also exhibit deteriorating chart patterns.

Back to top