China's Consumers Greet Year of the Rooster with Bling Splurge

This article by Bruce Einhorn and Daniela Wei for Bloomberg may be of interest to subscribers. Here is a section:

Retail sales rose 10.9 percent in December from a year earlier, the best monthly result in 12 months. Chinese imports of Swiss watches are up after falling for seven consecutive months through July, rising 7.9 percent in November from a year earlier. Led by its best-selling Macan SUV, Porsche had a 12 percent sales increase in 2016. Tiffany on Jan. 17 reported “strong growth” in China. On Jan. 19, Luca Marotta, chief financial officer of Rémy Cointreau, said the outlook for the Chinese New Year was “very, very positive.” Xi hasn’t ended his anticorruption drive, but its chilling effect on spending is easing. “A rebound across all luxury categories is now in progress,” Bloomberg Intelligence analyst Deborah Aitken wrote on Jan. 9.

During the Lunar New Year holiday, millions of Chinese will travel and shop at home and overseas. Bookings for international air travel made in December for Chinese New Year rose 9.8 percent from the previous year, according to ForwardKeys, an analyst of tourism data. Mainland tourist arrivals in the gambling hub of Macau jumped 7.8 percent in December, the largest increase since February 2015. Chinese consumers “are still very confident,” says Amrita Banta, managing director of Agility Research & Strategy, a consulting firm focusing on the affluent.

In Macau, tourist arrivals from mainland China for the first three days of the holiday period increased 9.1 percent to 234,000 compared to Chinese New Year in 2016, the Macau Government Tourism Office reported on its website Thursday.

Yet they may not be prepared to spend as much. Rather than purchase expensive items as gifts, Chinese are buying more for personal use, says Bruno Lannes, a Bain partner in Shanghai.

The strong weakness of the Yuan might currently be offering a tailwind for luxury goods companies since consumers have an incentive to buy now rather than pay more later. Additionally the potential for stronger economic growth and the knock-on effect that would have on consumer spending may be an additional factor in the outperformance of luxury goods’ stocks.

LVMH, Christian Dior and Kering have all developed short-term overbought conditions relative to their respective trend means. They are now looking increasingly susceptible to mean reversion.

Prada broke out of a yearlong base three weeks ago and a sustained move below the trend mean would be required to question medium-term scope for additional upside.

Salvatore Ferragamo has also broken out in the last few weeks.

TODs has a similar pattern.

Swatch Group rallied in October to break an almost three-year progression of lower rally highs and a sustained move below the trend mean would be required to question medium-term recovery potential.

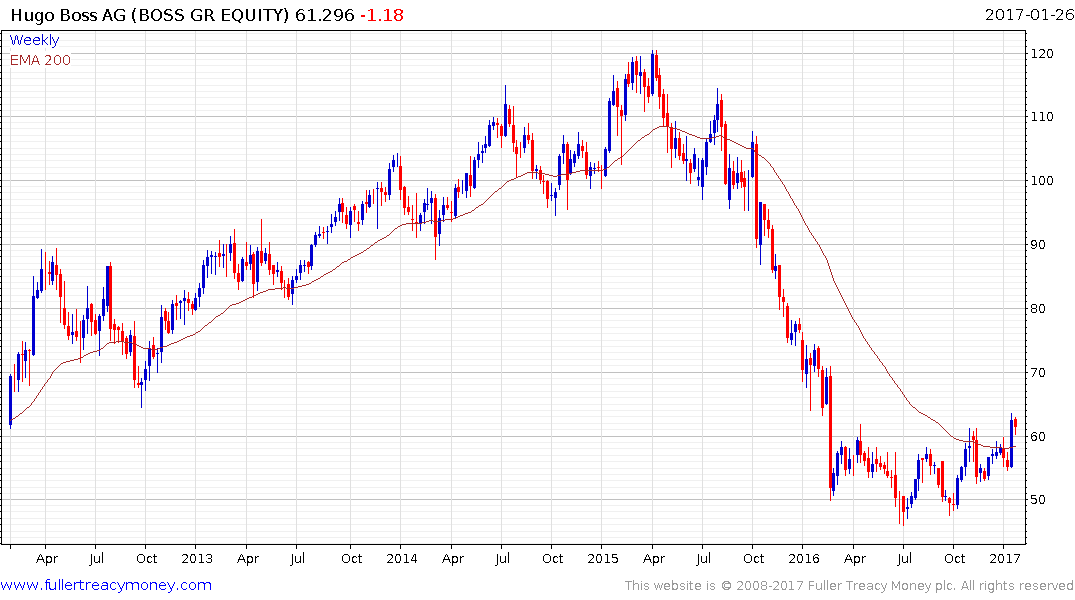

Hugo Boss appears to be in the process of completing a yearlong base formation.