Draghi Says Volatility Here to Stay as Global Bond Rout Deepens

This article by Susanne Walker Barton and David Goodman for Bloomberg may be of interest to subcsribers. Here is a section:

Draghi suggested several reasons for the rout in bonds across the region, including an improving economic and inflation outlook in the euro area, heavier issuance, volatility, poor market liquidity and an absence of certain investors. He also said that as shorter-term German bond yields rose through the ECB’s minus 0.2 percent deposit rate, making them eligible for purchases by the central bank, buying of longer-dated bonds was reduced.

Price Swings

“We should get used to periods of higher volatility,” Draghi said at a press briefing in Frankfurt on Wednesday. “At very low levels of interest rates, asset prices tend to show higher volatility. The Governing Council was unanimous in its assessment that we should look through these developments and maintain a steady monetary policy stance.”

Today saw a big move right across the government bond sector and across geographies. Rather than forecast where it may trade, the more important consideration is that Bund’s yearlong downtrend has been broken, support has been found in the region of the trend mean and that potential for additional expansion can be given the benefit of the doubt in the absence of a countermanding downward dynamic.

.png)

Two-year yields moved through -0.2% today and are approaching the region of the 200-day MA. With the central bank capable of buying at this level, there is perhaps less scope for an outsized move in the 2-year than the 10-year.

The yield curve spread has now rallied back above 100 basis points in a signal that the curve is steepening once more which is generally positive for the economy, particularly the banking sector, and suggests that the deflationary pressure on the Eurozone is easing.

.png)

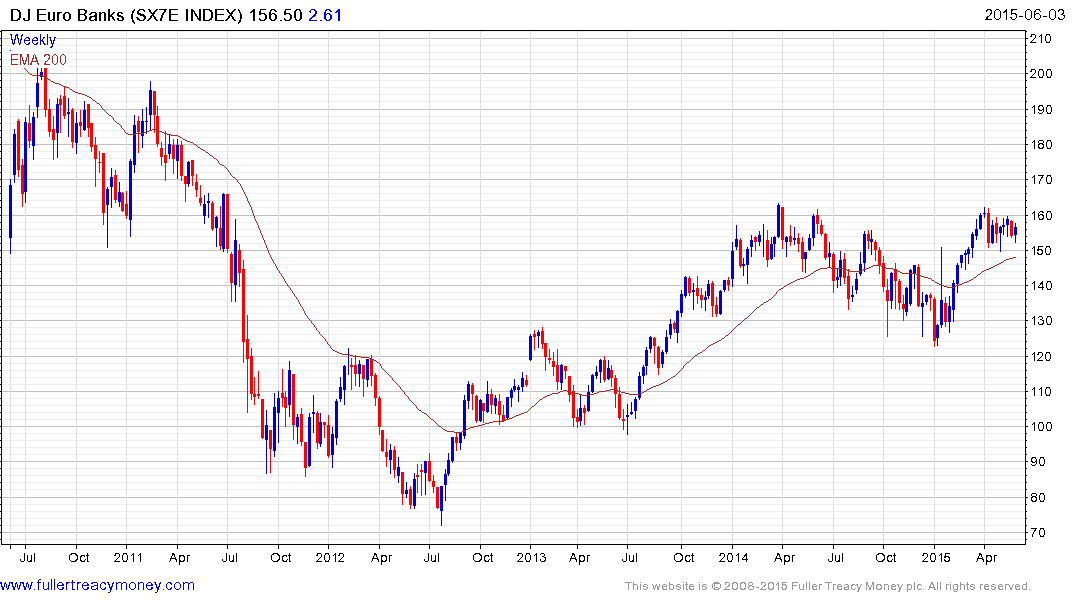

The Euro STOXX Banks Index has been consolidating between the 2014 highs and the trend mean since March and a sustained move below 150 would be required to question potential for a successful upwards break.