Email of the day on BHP Billiton and Australian monetary policy

Today's audio was very thought provoking. Please keep up the good work.

Your audio made me realize I have been too sentimental with some of my investments in particular I have kept a modest holding in BHP. BHP will survive and prosper - especially with the three big economies in this region of Japan, China and India. However investment prospects look more attractive elsewhere in particular the new economy.

The RBA should lower the OCR next Tuesday. Will they wait for more data? This opportunistic timing pre-Christmas should compel them to go sooner rather than later. Once the RBA starts lowering the cash rate it will not stop at a single 1/4 point drop. They could easily lower rates by 1% over the next 9 - 12 months. Of course I have no special information on RBA monetary policy however I did make a good living many years ago pre-empting RBA rate moves.

Thank you again for the excellent commentary in today's Audio.

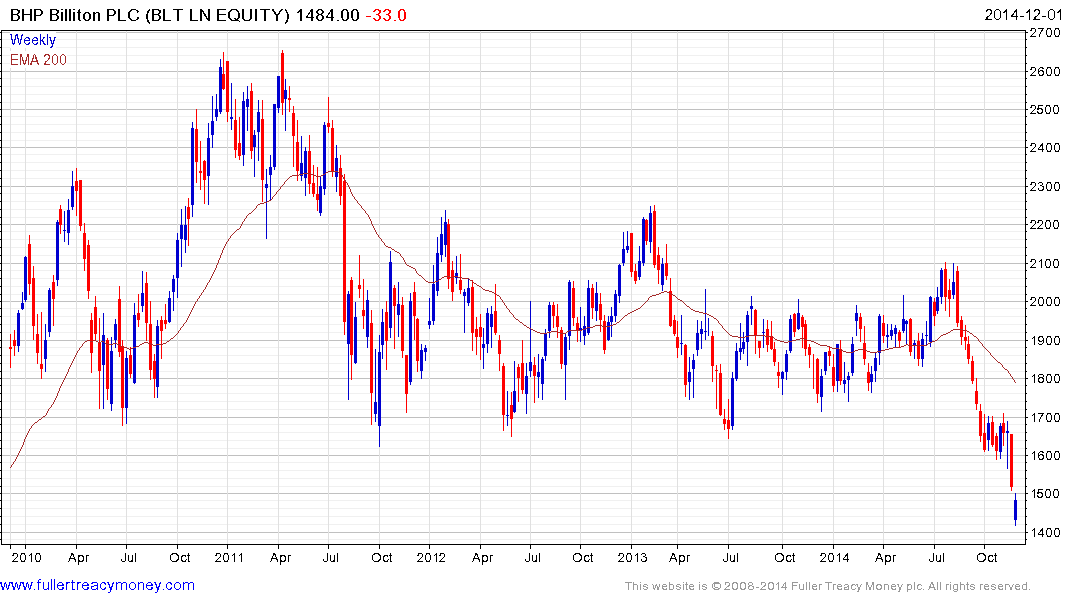

Thank you for your kind words. There are some big new items in the pipeline with regard to BHP Billiton’s demerger and Glencore’s potential acquisition of Rio Tinto both of which have the potential to be market moving events. At least in BHP’s case the rump of long life assets with established mines will carry less risk than those spun off and the company’s title as the only miner that is an S&P Europe 350 Dividend Aristocrat is likely to remain intact.

The share bounced from a new low today and potential for a reversionary rally has increased.

This note from Alliance Bernstein kindly forwarded by a subscriber may be of interest with regard to the RBA’s intentions. Here is a section:

Those factors are by and large falling into place, and it’s worth revisiting a couple of them. The most clear-cut is the commodity story. A continued decline in the iron-ore price, to below US$70 per metric tonne (MT) (Display 1), has again ignited the gloom around Australia’s commodity sector. This has been reinforced by the sharp fall in oil prices. While Australia is not yet recognized as a large-scale energy producer (as, for example, Norway and Canada are), the completion of seven new liquefied natural gas (LNG) “mega projects” over the next four years will catapult Australia to the position of one of the largest LNG exporters in the globe, according to the Bureau of Resources and Energy Economics. The new projects will increase the capacity in the sector from 24.3 million tonnes per annum (mtpa) in 2013 to 86.1 mtpa in 2018.

A large part of that export capacity has long-term contracts attached. Nonetheless, prices remain variable and are in general linked to oil prices. In other words, a sustained period of lower oil prices certainty has implications for revenues, profitability and so on from the projects.

And one way that this decline in national income is spread across the broader economy is via declining tax revenue, thus applying more fiscal stress. The extent of this stress should be revealed in the government’s next budget update in mid-December.

The RBA has more room than other developed market central banks to cut and it has an incentive to do so in order to weaken the currency further and bolster the domestic economy.

The S&P/ASX 200 Index rebounded impressively from the October low but pulled back over the last four weeks to retest it and will need to hold the 5200 area to offset medium-term top formation characteristics.

The banking sector remains a stalwart but it has returned to test the region of the 200-day MA and will need to hold that level if the medium-term progression of higher reaction lows is to remain intact.

Back to top