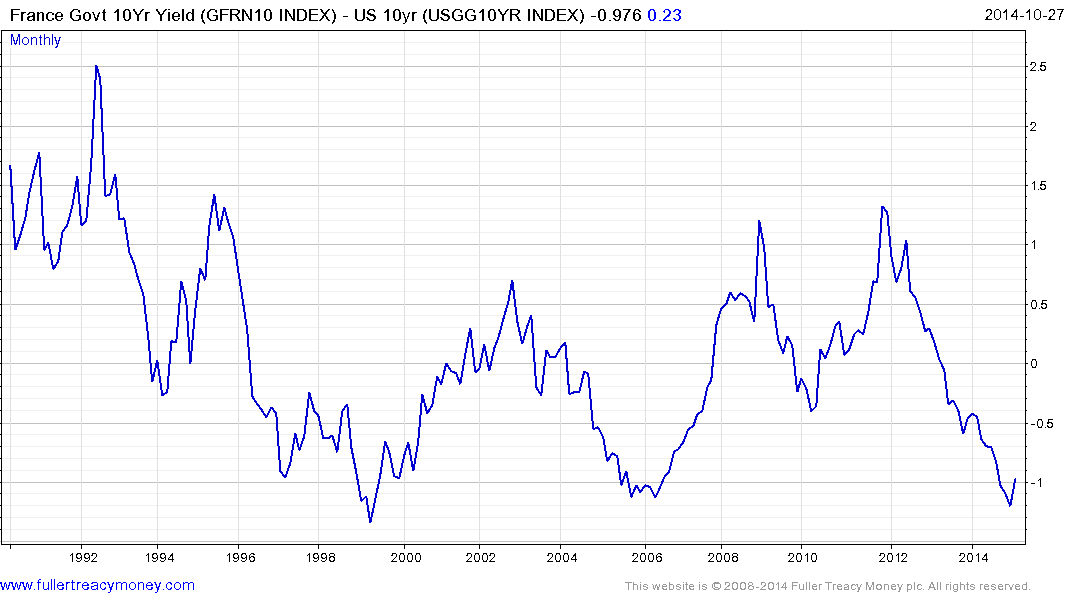

Email of the day on creating a spread chart

I am trying to set up a chart of the difference between the yield on 10yr French government bonds and the yield on 10yr US treasuries, but I haven’t figured out how to do this in a way that works. Could you point me in the right direction please?

Thank you for this question which may be of interest to other subscribers. To create the spread please follow these instructions:

You can find the 10-year French yield in the Bond Yields section of the Library or by using search with France as the keyword.

Once you have the chart click on the Charting tab located above the chart area.

Click on the green Other Relative button.

Type Treasury into the search box and click on Search.

Click on US 10yr Treasury Bond Yield in the results

Select difference from the dropdown menu in the Relative row.

Hit Apply.

Here is what your result will look like.