Email of the day on high yielding shares and private equity firms

Thank you for pointing out these high yielding shares. Generally speaking you don’t get something for nothing in this world so outsized yields while attractive do prompt the question of whether the outlook for the companies is likely to improve.

BHP Billiton’s spinoff of its more expensive to produce assets will probably leave the rump of the company better able to sustain its dividend and possibly continue to grow it incrementally in line with its fellow S&P Europe 350 Dividend Aristocrats.

KKR has substantial weightings in the consumer discretionary sector as well as finance, technology, communications and industrials. It has been increasing the dividend/partner distribution over the last few years and I’d welcome some feedback from the Collective on how sustainable this is.

I created a section in the Eoin’s Favourites section of the Chart Library for Private Equity companies in order to assess the sector’s commonality.

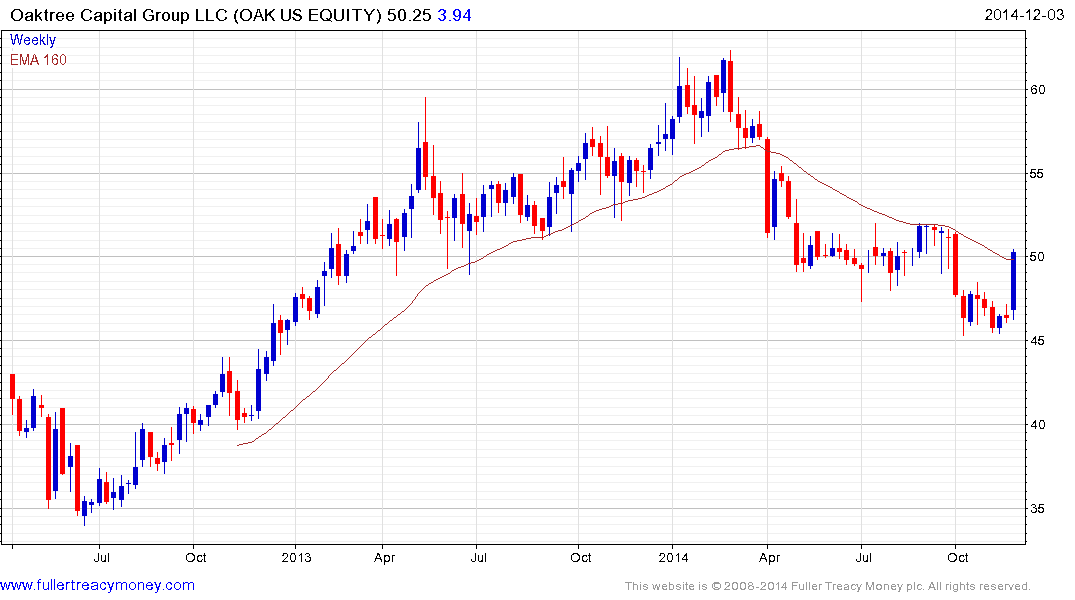

Competitive yields appear reasonably common for US listed private equity firms with Apollo paying 11.79%, Carlyle Group paying 10.92%, Oaktree Capital Group paying 6.49%, Blackstone on 5.8% and Icahn paying 5.58%. UK listed 3i Group pays 4.29%.

KKR, Apollo, Carlyle Group and Oaktree Capital Group have held progressions of lower rally highs this year and have rallied to test their respective 200-day MAs over the last month. Sustained moves above their trend means will be required to confirm returns to demand dominance beyond the short term.

Blackstone has been steadier.

3i Group has rallied for eight consecutive weeks to post a new recovery high and while some consolidation of this gain is looking increasingly likely, a sustained move below 400p would be required to question the return to medium-term demand dominance.

Swiss listed Partners Group does not pay a dividend but completed an almost 18-month long range this week. While somewhat overbought in the short term, a sustained move below CHF250 would be required to question medium-term scope for additional upside.

Back to top