Email of the day on London housing prices

Dear David, As you are based in London and well placed to view the situation do you agree with Jim Mellon's opinion that the London real estate sector is both overheating and over leveraged? He is also positive on Some areas of European property which is probably fairly consensus due to the current global QE game of pass the parcel from USA/UK to the EU. I can personally report from Spain a notable pick up in real estate activity from foreign buyers and the re emergence of many high street estate agents (closed since 2008/9) which is almost always a leading indicator on property activity (in both directions as I saw in Dublin 2008). I am currently happily invested in Foxtons which is still benefiting from the election feel good factor but watching it like a hawk (AKA Estate agent). best regards

David is on holiday at present in the beautiful Welsh countryside but I’ll bring your email to his attention when he returns. Here are my thoughts:

As a truly global capital London property has benefited from its attraction to foreign investors, the proximity of the City with its outsized pay structure, low interest rates on a global basis, an expanding population and the absence of a building boom have all contributed to London’s high price environment.

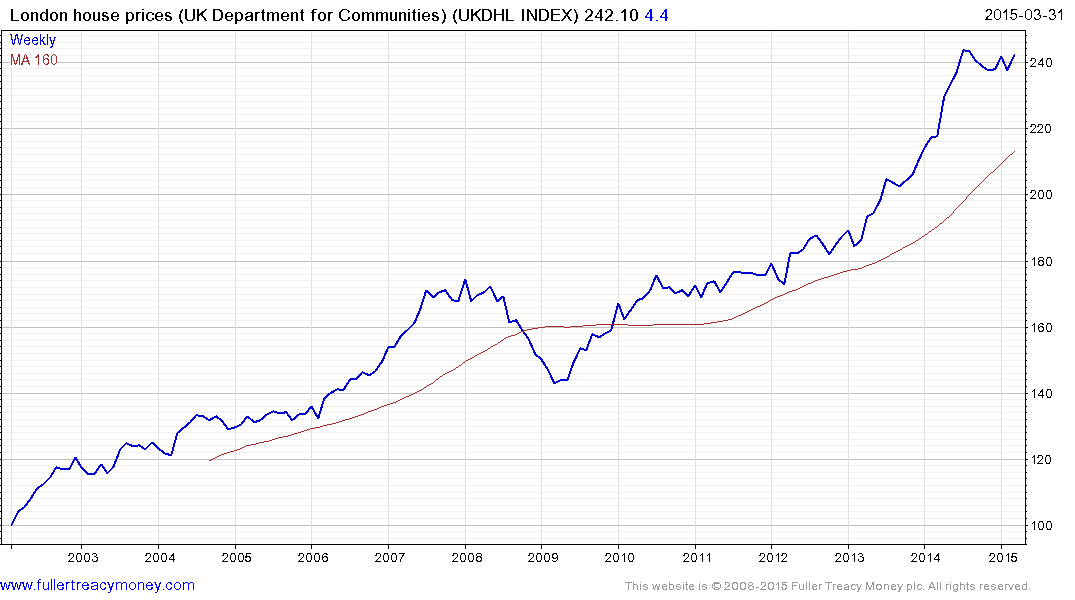

This chart of London property prices highlights the fact they have risen by 140% in 13 years from 2002. They have paused over the last year in what is so far a reasonably gradual process of mean reversion.

This chart of UK Nationwide Average House Price Index has been largely rangebound since 2007 and will need to hold the £180,000 level if the breakout to new highs is to be given the benefit of the doubt.

I believe it is worth pointing out that the shares of homebuilders in both the UK and USA acted as lead indicators for major trouble in the sector ahead of the financial crisis. Of course we do not yet know how the eventual normalisation of interest rates will affect the sector but we do know that this is a subject the Fed and Bank of England are very cognisant of.

The Bloomberg UK Homebuilder Index has a P/E of 13.73 and yields 4.81%. This is not an aggressive multiple and the constituents share a high degree of commonality. They are somewhat overextended at present following an impressive rally and are susceptible to mean reversion. However, a clear move below the 200-day MA would be required to question medium-term upside potential.

Well done on Foxton’s. The share has rallied for five consecutive weeks and a break in the progression of higher reaction lows, currently near 265p, would be required to suggest a process of mean reversion is unfolding.

It is encouraging that Spanish house prices are on a recovery trajectory. Considering how much they fell, the continued accommodative posture adopted by the ECB should be a tailwind. .

Back to top