Email of the day on the inverse correlation of gold to the US Dollar

It seems to me that with US gradually winding back monetary ease and Europe and Japan going the other way - surely the US Dollar must continue to appreciate while this status quo remains. Hence the gold/silver prices seem to have a major head-wind and further weakness may be in store. What are your thoughts and are you and David on the same wavelength?

Thank you for this question which was posted as a Comment to my piece on Centamin Gold last week and may be of interest to subscribers. David and I discuss markets every day and our opinions are seldom at odds. Part of the reason for this is because we base our interpretation on facts and try to eschew theories. I believe we share similar perceptions on precious metals.

The much remarked on inverse correlation between gold and the US Dollar is loose at best and probably more relevant to discussions about the outlook for the Dollar’s purchasing power than for gold. For example the Dollar was weak for much of last year and did nothing to arrest gold’s decline.

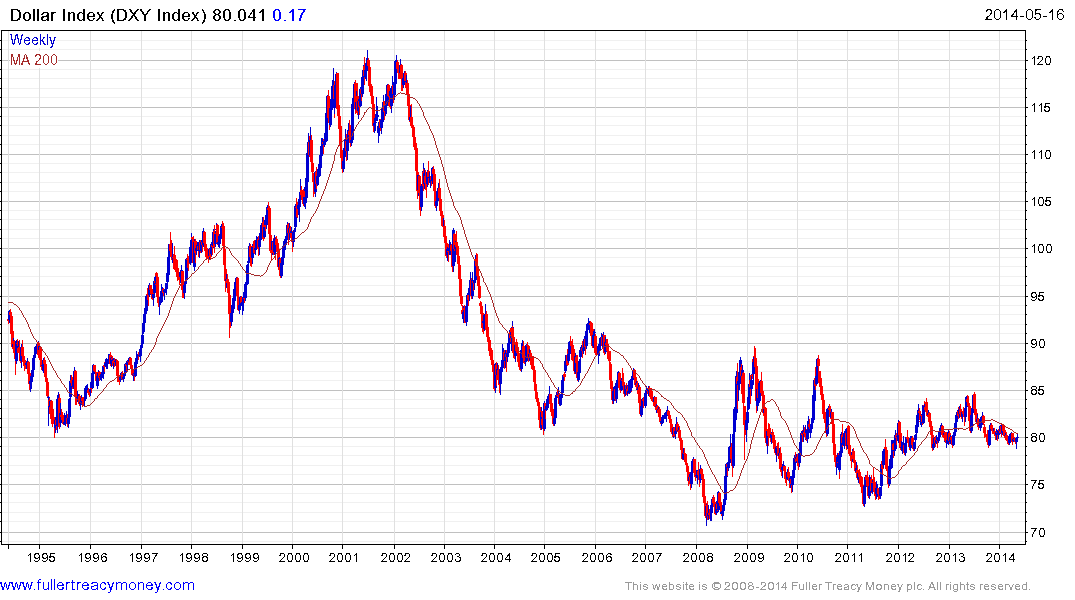

The Fed might be tapering but this has done nothing to check the trend of its balance sheet expansion. Part of the reason for this has been the contraction in the USA’s fiscal deficit which as required fewer Treasuries to be issued. I agree that the Dollar’s 10-year downtrend has at least lost momentum but a number of positive outcomes will need to fall into place, not least normalisation of monetary policy, before the Dollar Index trends higher on a medium-term basis.

Both Japan and the Eurozone need soft currencies and China appears to have abandoned its appreciating Yuan policy. We have long argued that gold is a monetary metal so it is reasonable to assume that it will be stronger and therefore more appealing to investors holding weaker currencies.

Both gold and silver have been ranging for much of the last year. Yes they could still move lower and this has been the outcome many investment banks have been hoping for. Silver is right at the lower side of its range near $19. It will need to continue to find support at this level if recovery potential is to continue to be given the benefit of the doubt. Gold continues to hold in the region of its 200-day MA and has posted two upside key day reversals in the last month. It has so far failed to follow through to the upside and this will be required in order to confirm a return to demand dominance in this area.