Emails of the day on India's new currency notes

Rupees: for the sake of clarity following your comments of the 9th and today, please note that the R1000 is being replaced by the new R2000. The net effect, therefore, is to increase the circulation of high-value notes. So far as gold is concerned, now that so many people have learnt that fiat money can be made valueless at a stroke, the attraction of keeping some money in precious metals has increased. (I am visiting India and have found it salutary to have a practical lesson in what I had always understood theoretically.) My guess is that the recent decline in gold follows expectations of rising interest rates.

And

Any follow-up to your article discussing the demonetisation of India's 500 and 1,000 rupee notes? The Bombay Bank Index initially shot up but has retraced all of the move. Chaos seems to have ensued, but would like to hear from the community

Thank you for this clarifying that the removal of the old R1000 and R500 notes is in fact about removing old notes from circulation and forcing consumers and business people to move onto the new notes. The primary aim would appear to be to get more people to declare their income but as you point out the introduction of a new R2000 note is also a potential source for new black market activities.

If the government really wanted to clamp down on the use of cash it would promote the use of debit cards and POS machines which are still quite rare in India. This article from financialexpress.com carries more details.

The US Dollar is rallying because interest rates are likely to rise faster than other jurisdictions, which is a headwind for gold in the short term. However as you point out gold is an asset that cannot simply be printed or lent into existence and therefore tends to do best when the crowd realises the paper in its pocket is losing purchasing power.

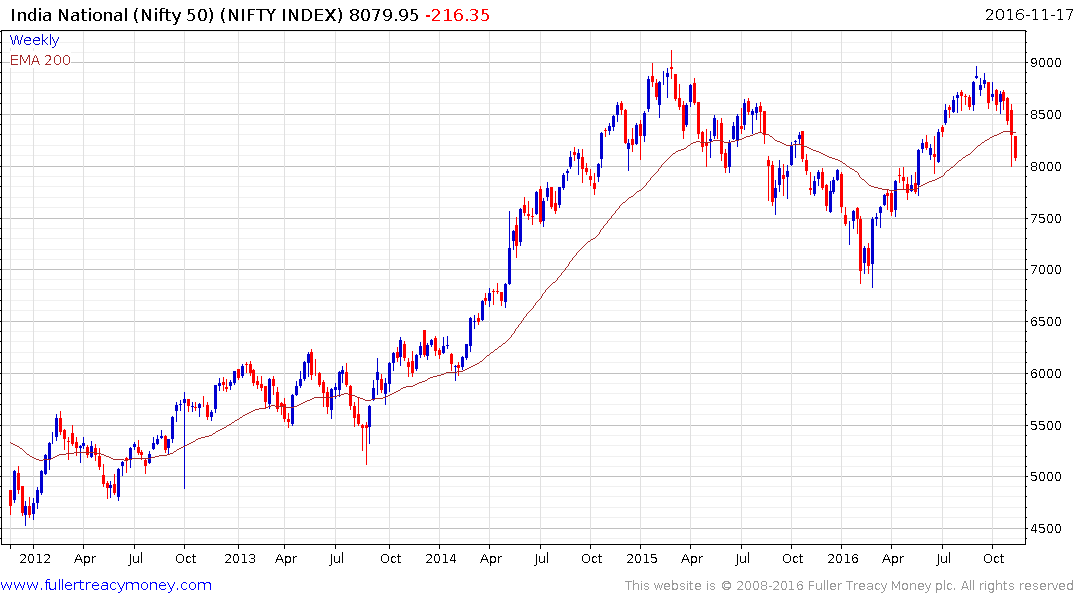

The Indian stock market is also reacting to interest rate risk in the USA because with a stronger Dollar a higher spread is required by global investors to justify the additional risk of buying emerging markets when their currencies are not appreciating. That is a challenge facing most emerging markets not just India but it is also worth highlighting that India is potentially in a better position than many other markets to weather this challenge.

Indian 10-yr government bond yields are accelerating lower as the growth outlook for the next couple of years holds above 7% and the prospect of additional RBI rates cuts next year remains the base case.

The Bombay Banks Index continues to range between 21,000 and 24,000 and will need to hold the region of the trend mean, which currently coincides with the lower boundary, if medium-term scope for additional upside is to continue to be given the benefit of the doubt.