Gemfields recalibrating supply for a softer market

This article by Warren Dick may be of interest to subscribers. Here is a section:

Production at the company’s 75% owned Montepuez ruby mine rose by 29% to 8.4m carats of ruby and corundum. A maiden JORC statement for Montepuez was published in July 2015 indicating probable ore reserves of 432m carats with an NPV of $996m.

Further steps were taken post reporting period, with the company entering into two transactions to source supply of gemstones in Colombia – a country with a 500-year history of producing world renowned emeralds. “The results speak for themselves – I am extremely proud of what we have been able to do,” says Harebottle.

But it’s the work on the demand side that really sets Gemfields apart from its competitors and other mining companies. “Gemfields is the only company taking a leadership role [in this regard] – so we are price makers, not price takers. We the have potential to ramp up production, but we prefer to do so slowly and steadily, and in conjunction with the needs of our sightholders,” says Harebottle.

Faberge’ produced a “Pearl Egg,” the first such created in the Imperial Class since 1917. The egg was sold within hours of unveiling at the Doha Jewellery and Watches expo. Faberge’ also launched four new timepiece collections during the year, something that will be supported by the addition of eight more retail outlets.

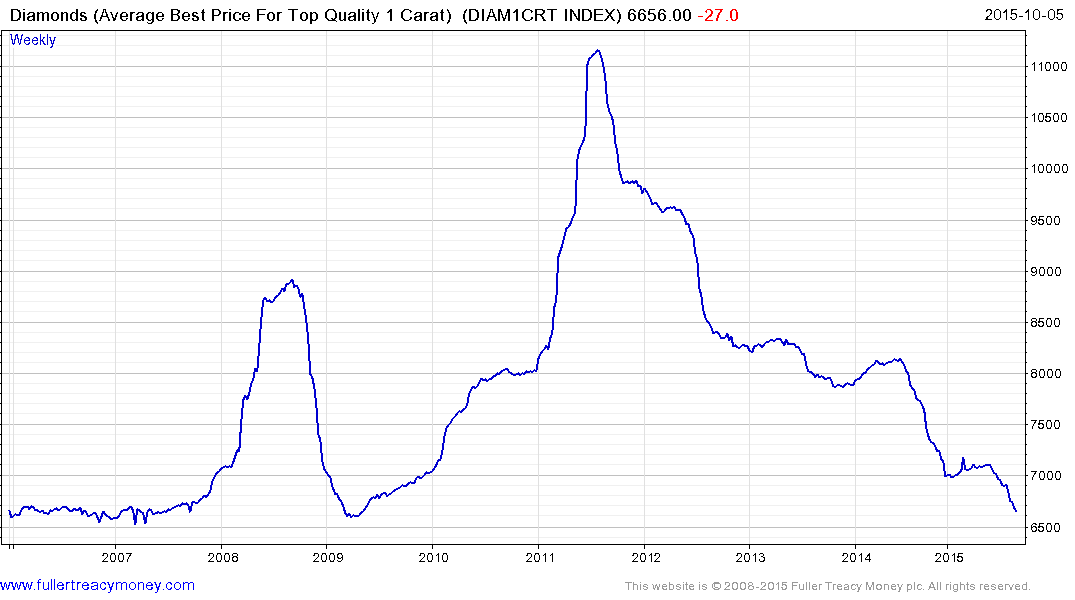

The diamond market has become a lot more efficient with the introduction of Rapaport pricing models for both rough and polished stones. This has for the first time allowed consumers to price check on a carat for carat basis between suppliers and the jewellery sector has been rocked as a result. Prices for 1 carat stones are now back at lows not seen since 2009.

The coloured stones market is a lot less transparent and because prices are generally lower there is less incentive to make it more efficient. This has enabled Gemfields to lever favourably its impressive assets and the stock has rallied impressively from 2010 until recently.

Harry Winston Ltd sold its jewellery business to Swatch in 2013 while holding onto its diamond mines. The company had been one of the few remaining mines that operated a retail jewellery network and its exit from the business illustrates how difficult it is to operate such a business model. With Faberge, Gemfields is attempting to do with coloured stones what Harry Winston decided was too much effort with diamonds. If successful it has the capacity to join the ranks of major luxury brands.

The share (Est P/E 19, DY N/A has returned to test the 50p region and will need to continue to hold that area if medium-term scope for continued higher to lateral ranging is to be given the benefit of the doubt.