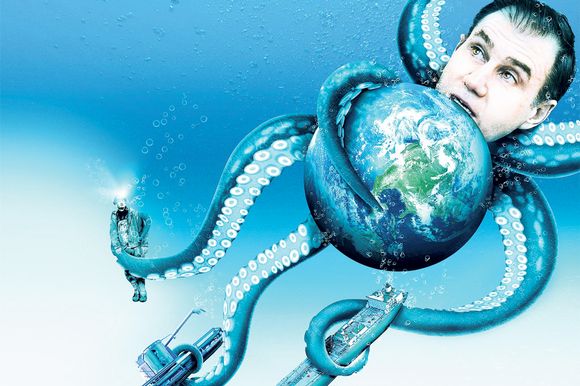

Glencore: "The ultimate vampire squid"

The money-making tentacles of commodities giant Glencore has some dark secrets, including betting on grain while the developing world riots over food.

Ivan Glasenberg controls the empire that touches everything from iPhones to petrol (STO)

High in the Andes lies one of Bolivia's most prized assets. The Vinto tin smelter churns out 80% of the country's exports of the metal, used in everything from fizzy drink cans to high-end electronics. The price of tin has tripled in the past two years, so when Vinto put several thousand tonnes up for sale a few months ago, it had plenty of interest.

One bidder outdid them all. Sinchi Wayra is one of Bolivia's biggest miners. It paid more than double what Vinto expected, and trounced other suitors, including the Japanese car giant Toyota.

Mining companies wouldn't normally take part in such an auction. Did Sinchi know something its rival bidders didn't? In a word - yes. Sinchi is not simply a miner, but part of Glencore, the world's biggest commodities trader, which last week announced plans to float in London at a blockbusting £37 billion valuation.

The bet on tin was the type of trade only Sinchi's parent would, or could, make. Glencore is one of the biggest miners in the Democratic Republic of Congo, the war-torn country that produces copper, cobalt, gold and tin. Its traders, based in the Swiss town of Baar, spotted early that sales of tin and other metals from Congo had started to slip.

The US Congress last year passed the Dodd-Frank act, a sweeping law that will force firms to declare if they buy Congo's "conflict minerals". It hadn't yet taken effect but buyers had already begun looking to fill their orders elsewhere. As Congolese supplies dried up, the resulting squeeze sent tin in February to an all-time high - three months after Sinchi tabled its knock-out bid.

Such deals are the life-blood of Glencore. The 37-year-old firm produces, trades and ships more raw materials, from wheat and oil to coal and gold, than any other company. It has built an unparalleled global network of assets by going into countries like Congo and Bolivia where others wouldn't set foot, following the resources regardless of who holds them. Its traders draw on that base to weave together an unrivalled picture of supply and demand.

Until recently it worked its magic in cosy Swiss anonymity. The float changes that. It will be the largest wealth creation event since Goldman Sachs went public 12 years ago. Five of its top executives will become billionaires, led by chief executive Ivan Glasenberg, whose 15% stake will be worth $9.6 billion (£5.9 billion). Hundreds of junior staff will become multimillionaires.

The payday comes with a price: transparency. To convince investors to buy in, Glencore had to bare all. Last week it issued a 1,600-page prospectus that for the first time revealed the full extent of its empire.

It makes for some uncomfortable reading: dealings with corrupt regimes, bets on grain while the developing world riots over food, environmental problems in desperately poor African countries. It was also forced to fight off suggestions its float signalled the top of the market. As if on cue, Brent crude had its largest single day drop in history. It closed at $115 a barrel - down $13 on the week - leading a retreat across commodities.

Goldman may be the original "vampire squid" but Glencore's tentacles stretch much further into our lives. Whether it's the iPhone in your pocket, the petrol in your car or the food on your plate, it's a good bet that before it got to you, Glencore had taken its cut.

My view - Glencore is certainly one of the most intriguing floatations in recent years and I look forward to monitoring and commenting on the share once a post-listing trend develops.

David Fuller's view Glencore is certainly

one of the most intriguing floatations in recent years and I look forward to

monitoring and commenting on the share once a post-listing trend develops.

I also imagine

that I will be participating, indirectly, via my long-term investment in the

BlackRock World Mining Trust.

As

a commodity company, Glencore is a large addition to one of Fullermoney's favoured

secular themes. However, I will be content to watch and comment from the sidelines,

at least initially.

While Glencore's

prospects will be closely allied with the secular bull market in commodities,

this appears to be in a mean reversion corrective phase, as I have mentioned

recently. Also, it will be interesting to see how the company copes with the

additional analytical and possibly regulatory scrutiny, once it is listed.

With all that

flotation dosh arriving, Glencore's management and staff may be distracted by

the nouveau riche lifestyle, which will include some career changes and divorces.

Here is an apt

email sent to The Sunday Times, slightly edited for spelling and punctuation:

"Ruthless,

secretive, amoral, devious, single minded, ubiquitous and global; (I am beginning

to run out of superlatives). Not to mention very, very, very, rich. Are those

qualities appreciated in The City? Do you think the flotation will be a success?

Or does day no longer follow night?"