Gold Investing Goes AWOL As Google Searches To 'Buy Gold' Hit 11-Year Low

Thanks to a subscriber for this article by Adrian Ash which may be of interest. Here is a section:

The giant SPDR Gold Trust (NYSE Arca: GLD) shrank 4% across May, erasing the previous two months of share issuance growth with the heaviest 1-month outflow since August last year.

The US Mint meantime reports selling 24,000 ounces of American Eagle gold coins, up sharply from April's 10-year low as dealers re-stocked inventory but still barely half the last 5 years' average for May.

Here at BullionVault, last month saw the lowest number of new precious-metal investors since May 2014. Down 27.7% from the previous 12-month average, the number of people using our online gold, silver and platinum market for the first time totalled just 57.2% of the last 5 years' average monthly count of new customers.

Overall, the number of people starting or increasing their gold holdings rose 12.1% from April's 27-month low, but the number of gold sellers on BullionVault rose 22.8% to a 4-month high.

Some people buy gold because it is the “anti-Dollar”. Some people buy gold because it is a monetary metal. Some people buy gold because it is store of value. Some people buy gold because it is in relatively short supply. Some people buy gold because it is lasts forever and cannot be printed into existence.

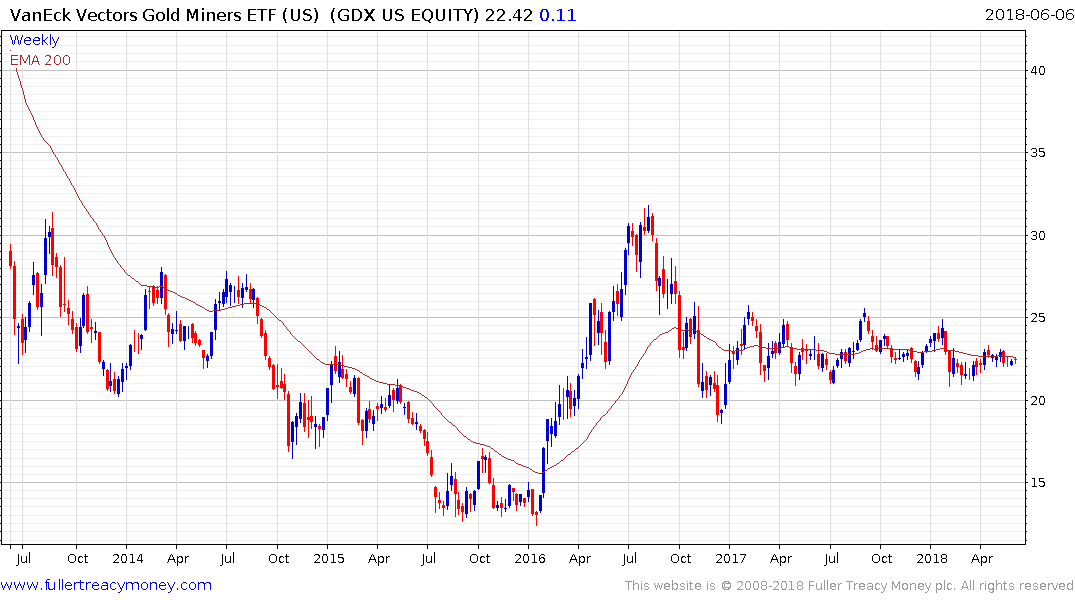

All of these people are to one extent or another agnostic to price. They buy it as a hedge or as insurance against calamity. However, those at the margin who are interested in making money quickly buy gold because it is volatile. That is not the case right now. Gold, silver, platinum and related mining shares have been relatively inert for months which I suspect is the reason for declining interest sites like Bullionvault.

For contrarian investors that really is very good news. We know that gold is historically volatile so when it breaks out, it is likely to do so in a dynamic manner. The question of course is in which direction is it likely to break out?

I am reasonably encouraged by the fact that ETF Holdings of Gold might have paused but have so far held the breakout to new recovery highs.

Additionally, the chart pattern on silver in particular looks like a Type-2 bottom with righthand extension characteristics. It’s hard to say what the bullish catalyst is likely to be but precious metals tend to do best when people lose faith that the central bank is fighting inflation or is intentionally debasing the currency. There is the realistic potential that central banks will be willing to let inflation run hot so that could be a factor in precious metals completing their bases.