Gold Seen Entering Long-Term Bull Cycle as Asset Bubbles Pop

This article by Ranjeetha Pakiam for Bloomberg may be of interest to subscribers. Here is a section:

Parrilla joins a slew of investors who are bullish on gold because of low borrowing costs and central-bank bond buying. Billionaire bond-fund manager Bill Gross has said there’s little choice but gold and real estate given current bond yields, while Paul Singer, David Einhorn and Stan Druckenmiller have all expressed reasons this year for owning the metal.

Some are not confident prices will rise. The probability of three rate hikes through end-2017 means there’s little room for rallies, according to Luc Luyet, a currencies strategist at Pictet Wealth Management. Cohen & Steers Capital Management, which oversees $61 billion, has pared its gold allocation, while investor Jim Rogers said after the Brexit vote in June that he’d rather seek a haven in the dollar than bullion.

While global bond yields are still very low, they’ve been rising. Yields have climbed to 1.21 percent from a record low 1.07 percent in July, according to the Bloomberg Barclays Global Aggregate Index in data going back to 1990. The odds of the Fed hiking in December have risen to 58 percent after the U.S. reported higher-than-expected inflation in August, from just below 50 percent on Thursday.

Despite the fact precious metal prices have been in a reaction and consolidation for the last few months, the biggest bulls are unabashed because they don’t see a solution to how central banks can support growth while simultaneously reducing the debt mountain without the assistance of inflation which could involve helicopter money.

Gold trended lower between 2011 and late 2015 but has staged an impressive rebound this year. It has posted two reactions in the course of that rally. The first was between February and June and had a peak to trough spread of about $100. The current reaction has been in evidence since the July 6th peak and so far has an amplitude of almost $80. The first range bounced from the psychological $1200, while it has bounced from the $1300 level in the second range. It has not quite yet unwound its over extension relative to the trend mean but today’s steadying from the lower side of the range will be encouraging for bulls. If the $1300 area holds we can conclude gold is in a medium-term staircase step sequence uptrend.

The NYSE Arca Gold Bugs Index experienced its largest reaction this year from the July peak and has been ranging in the region of the trend mean since August. It also firmed today, to help confirm support in the 225 area, and a sustained move below the 200-day MA at 215 would be required to question medium-term recovery potential.

Silver, which we often refer to as high beta gold, has now posted a higher reaction low. It is testing the psychological $20 area and a sustained move above it would confirm a return to demand dominance beyond the short term.

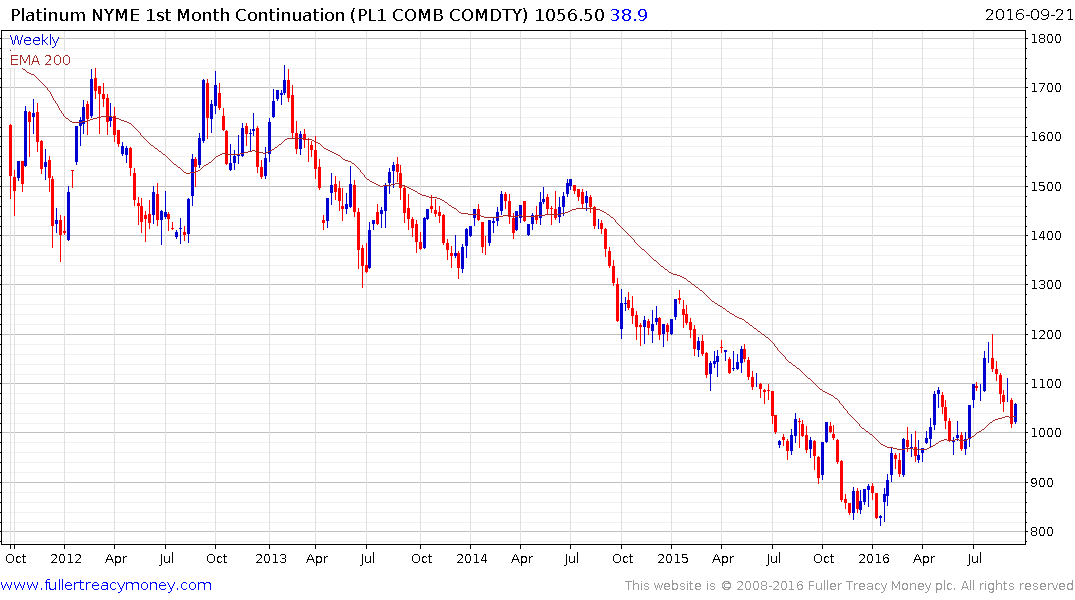

Platinum has bounced to confirm at least near-term support in the region of the trend mean but will need to sustain a move above $1100 to confirm a return to medium-term demand dominance.