GTI: Keep an Eye on This Young Fellow

GTI's "Emerging Middle Class" investment theme is the investment theme of the next decade

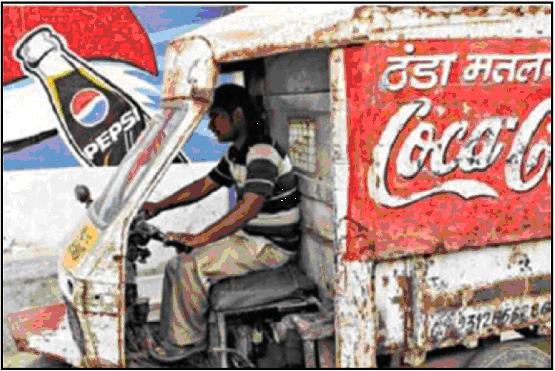

He's GTI's New Best Friend. He's young, hard working, needs an upgrade on his vehicle, is saving up for a wrist-watch on his arm, a mobile phone and doesn't mind if he drinks Coke or Pepsi - both taste just fine. He's energetic and ambitious, and - beware - thinks that he next century belongs to him. Whatever happens, he's determined to live better than his parents.

He's our friend because he's going to ensure that GTI's "Emerging Middle Class" theme will make more money for more people in the next 20 years than any other form of equity investment in history.

That's our confident prediction. When 25-50% of the world is taking part as investors and agents of change, it's not really so brave to be so confident.

A titanic transfer of wealth is occurring from ageing and mature, post-industrial countries (USA, UK, Germany, France etc) to faster-growing, younger and more vigorous developing countries. Between 2 and 4 billion new consumers are going to vie with each other to become the new consuming "middle class"; that's getting on for 25-50% of the world's population. This is a larger infusion of hungry mouths and itchy wallets than we've seen at any time in history.

Investors who don't plan for this in their strategies - as night followsday - will miss out on this historic opportunity. Worse, many in the West will become road-kill on the Emerging Middle Class Consumer Highway (through job losses, loss of currency purchasing power, educational under-achievement, shifting economic opportunities etc). So it'll be a "double hit" for those who don't invest now. One of the few ways to protect your family from this shift and profit from it is to find good "Emerging Middle Class" theme investments.

David Fuller's view Veteran subscribers will not be surprised by this view but GTI provides some fascinating graphics to support it.

Having read all the way through this GTI report, I think it is the best in a very good series and packed with information on many Fullermoney secular themes. I commend it to subscribers.

The graphics on real inflation by sector are shocking, if not surprising. I have talked about the real inflation that every middleclass household encounters, as opposed to the hedonic CPI statistics, for decades because I could see it all around me. GTI provides the data for US inflation in graphic form, since 1969 and over the last ten years in a separate graph. Medical and education fees top the extensive list.