China Moves to Secure Commodities Rocked by Ukraine War

This article from Bloomberg may be of interest to subscribers. Here is a section:

China is heading into peak demand season for many commodities, and the risk of supply disruptions because of Russia’s invasion of Ukraine will exacerbate rising prices of everything from metals to fertilizers.

Buyers are already looking beyond Russia and Ukraine for supplies as disruptions set in. With Belarus’ potash sector under U.S. and European sanctions, China is now paying 139% more than what it did a year ago to secure imports from Canada and Israel.

In energy, Chinese power plants and steelmakers are seeking alternatives to Russian coal after some domestic banks suggested they avoid purchases due to the mounting sanctions being imposed on Moscow. Russia is China’s second-biggest source of overseas coal after Indonesia.

Russia, which vies with Saudi Arabia as China’s biggest seller of oil, has strengthened trade ties with Beijing over the past decade. China has doubled purchases of energy products from its neighbor over the last five years, to nearly $60 billion.

China has deep pockets and is not about to let food prices get out of control in a year when Xi Jinping is looking to cement his hold on lifelong power. That suggests they will be aggressively buying in size to ensure they meet domestic demand. No that the Winter Olympics is over, China’s metal bashing industries will be eager to get back to business as usual.

With Brent crude oil prices up another $8.30 today to $113, there is a clear incentive for China to buy Russia’s heavily discounted Urals Medium Crude. The spread is currently at $9.52 and widening. If they opt instead for more Middle Eastern supply, it would be a further souring of the newly minted friendship between the two countries.

Putting sanctions on Russian refineries contributed to a significant jump in gasoline futures today. It is now back in region of the all-time peaks. While short-term overbought, a clear downward dynamic will be required to check momentum.

Putting sanctions on Russian refineries contributed to a significant jump in gasoline futures today. It is now back in region of the all-time peaks. While short-term overbought, a clear downward dynamic will be required to check momentum.

Fertiliser prices are marching higher and Mosaic is now quite overbought in the short term. So are the vast majority of fertiliser stocks. Nutrien, Israel Chemicals, CF Industries etc. all share similar patterns.

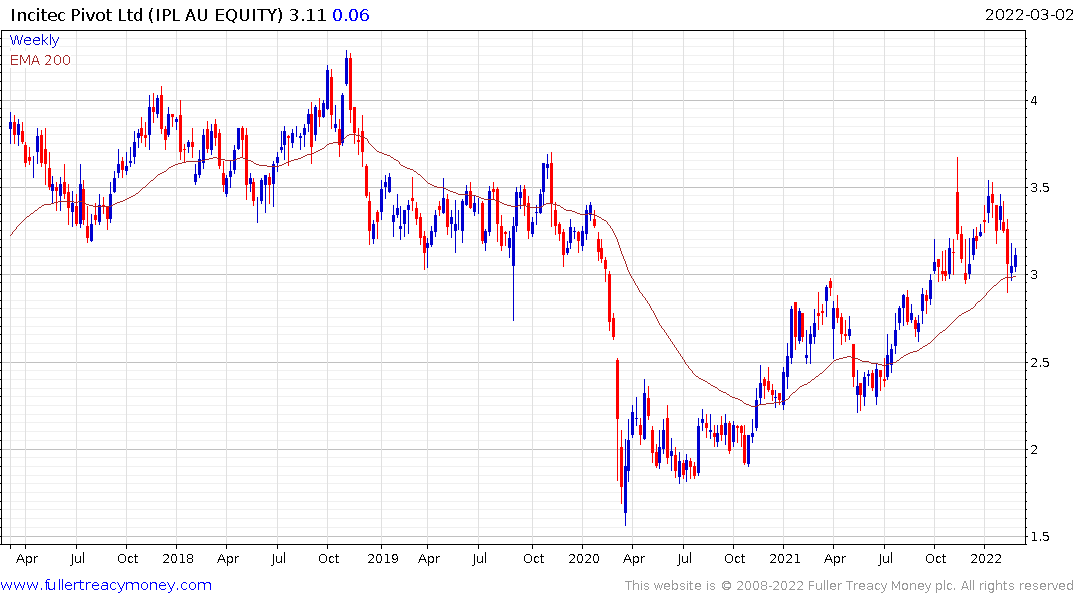

Australia’s Incitec Pivot is currently firming from the region of the trend mean and has potential to play catch up. It has been inhibited from following the global sector higher because of the taught relationship between the Australian government and China.