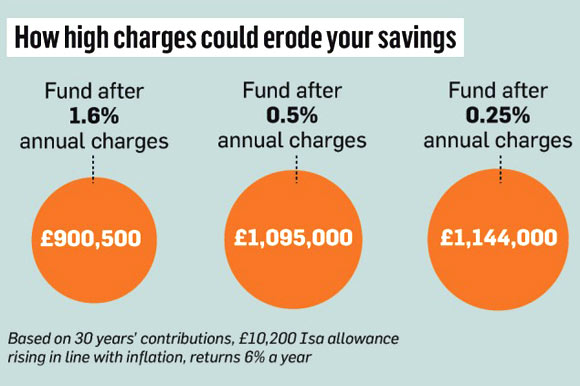

How High Charges Could Erode Your Savings

Investment fund charges could knock £243,400 off the value of your Isa portfolio over 30 years of investing, according to figures produced for The Sunday Times by Vanguard, the American fund manager.

The figures, which assume the Isa allowance rises in line with 2% inflation each year for the next three decades and that investment returns are 6% a year, show that if you invest in funds costing the industry average of 1.65% a year, you would be left with a pot worth £900,478, compared with £1,143,847 for funds costing 0.25% a year.

A growing realisation about the effects investment charges have on your savings over the long term is one reason many Isa investors are taking charge of their portfolios by using self-select Isas and execution-only stockbrokers this year.

According to Interactive Investor, the online stockbroker, the number of people using self-select Isas has risen by more than 50% this tax year to nearly one in three.

While Isa wrappers offered by most fund managers provide access to only that manager's range of unit trusts, with sometimes a limited selection of unit trusts from other managers, self-select Isas usually provide access to a much larger range of investments and allow you to hold other lower-cost equity-based assets such as investment trusts and shares.

Most actively-managed unit trusts levy an initial charge of about 5% - though this can be discounted if you invest via most advisers or discount fund brokers instead of going direct to the manager - as well as an annual management charge of about 1.5%.

Of this, however, only about half goes to the manager, while the rest is paid as "trail commission" to the financial adviser or investment platform through which you buy the fund.

Tim Cockerill at Ashcourt Rowan, the adviser, said: "All fees eat into the return an investor can make and the bigger the fee, the more the damage they do to the return."

Shares, investment trusts and exchange traded funds (ETFs), however, pay no commission so cost less to invest in.

We look at the alternatives and identify the best self-select and execution-only Isas

David Fuller's view This is familiar ground for most of us but it is still a useful reminder to see these statistics from the article:

For these reasons, when dealing with managed funds I have a strong preference for investment trusts (ITs) (close-end funds), provided they trade at a discount to net asset value. However, some ITs launched over the last decade also have high fees, so before buying investors should conduct their own due diligence by Googling a fact sheet or prospectus for the fund as these will list charges.

My one point of disagreement with the article above is that I do not like ETFs because of their hidden expenses.

Index trackers are mainly promoted on the basis of their low management fees, normally less than 1% per annum, and the fact that few investment managers actually outperform their benchmarks after fees are deducted. This is true but I have three reservations about trackers:

1) To maintain weightings they bid up the price of popular and ultimately overvalued shares in the index, at the expense of undervalued components; 2) This activity increases the tracker's share dealing costs, as do changes in the index; 3) The index in question may not provide the coverage that one might prefer.

Additionally, some ETFs do not always track very successfully, evidenced by their 'slippage' rates relative to the index being tracked, which they are required to make public.