MF Metals Focus

Thanks to a subscriber for this report focusing on the outlook for the precious metals sector. Here is a section:

Looking ahead, we see the near-term price outlook for both metals remaining largely rangebound, with a bias to the downside. This reflects the impact of an improving US economy and looming interest rate rises which will continue to discourage investor buying and may in fact lead to modest selling. The turning point for prices is likely to emerge around mid-2015. Perhaps surprisingly, the catalyst is likely to be interest rate rises in the US. With the authorities reluctant to risk derailing the US recovery, we expect only modest and slow rate increases, which should benefit gold. The yellow metal should also benefit from improving fundamentals, such as cost curve support and continued gains in jewellery demand. Furthermore, silver is expected to outperform gold next year, boosted by its own improving fundamentals, including falling scrap volumes and, more importantly, further growth in industrial silver offtake.

Here is a link to the full report.

Veteran subscribers will recall our refrain from the early to late 2000s “Don’t pay up for commodities.” The reason for this is because the sector is often characterised by volatility even in a medium-term demand dominated environment. The lowest risk entry point in a choppy trend is generally when prices sell off, when oversold conditions are evident and when a general sense of revulsion pervades investor psychology.

One of the reasons a trend becomes more consistent as it progresses is because a buy-the-dips strategy works so well. As expectations improve market participants are willing to wait less time before buying because they are unwilling to risk missing out on higher prices. As the trend evolves momentum strategies begin to pay off and more people pay for new highs than are willing to wait for a dip. Following a big pullback, leverage and momentum traders are squeezed out and value seekers will need to start coming back in following contractions if a new uptrend is to develop.

Gold bounced over the last four days from the lower side of its 18-month range. It is too early to begin to talk about medium-term recovery but there is ample scope for an unwind of the short-term oversold condition. Over the medium-term, the progression of lower rally highs evident since 2012 will need to be broken, with a sustained move above $1340 to signal a return to demand dominance beyond scope for a reversionary rally.

Silver broke downwards from its 18-month range in September and is now unwinding its short-term oversold condition. However it will need to sustain a move above $18.50 to signal a failed downside break and increase potential for a rally back up towards the upper side of the overhead range.

Platinum fell precipitously on consecutive weeks until this week and developed a short-term oversold condition in the process. It bounced emphatically this week and potential for an additional reversionary rally back up towards the mean is improving. However the progression of lower rally highs evident since the peak since 2011 is still intact. A period of support building and an eventual sustained move above $1500 will be required to signal a change to the medium-term supply dominated environment.

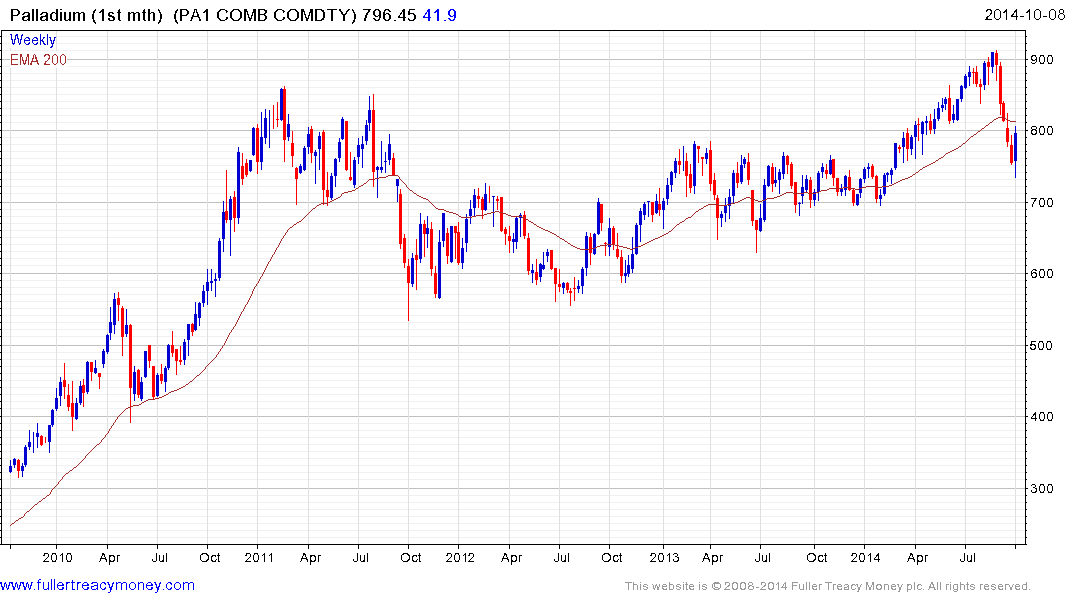

Palladium experienced a steep decline from the September peak near $900 and found support on Monday near $740. An unwind of the oversold condition is a possibility but it will need to find support above this week’s low on the next significant pullback to confirm a return to demand dominance beyond the short term.

There has been climactic selling activity in the precious metals but they will need to hold their recent lows on the next significant pullback to confirm lows beyond short covering rallies.

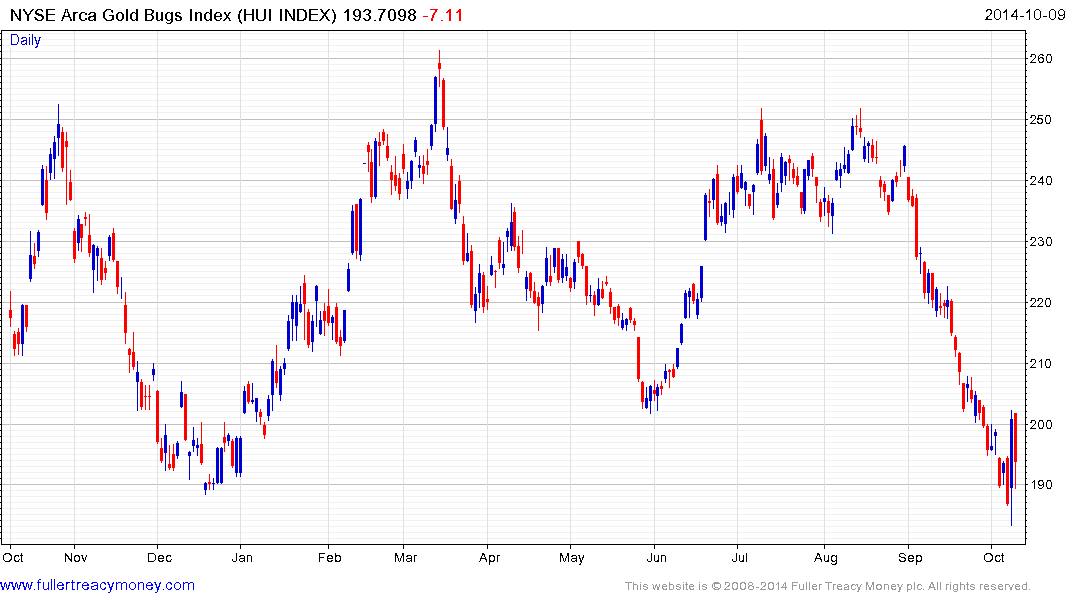

The NYSE Arca Gold Bugs Index has also fallen on consecutive weeks, but posted an upside key day reversal yesterday. It will need to follow through to the upside to confirm support is returning beyond the short-term but from perusing individual shares there are some clear winners and losers.

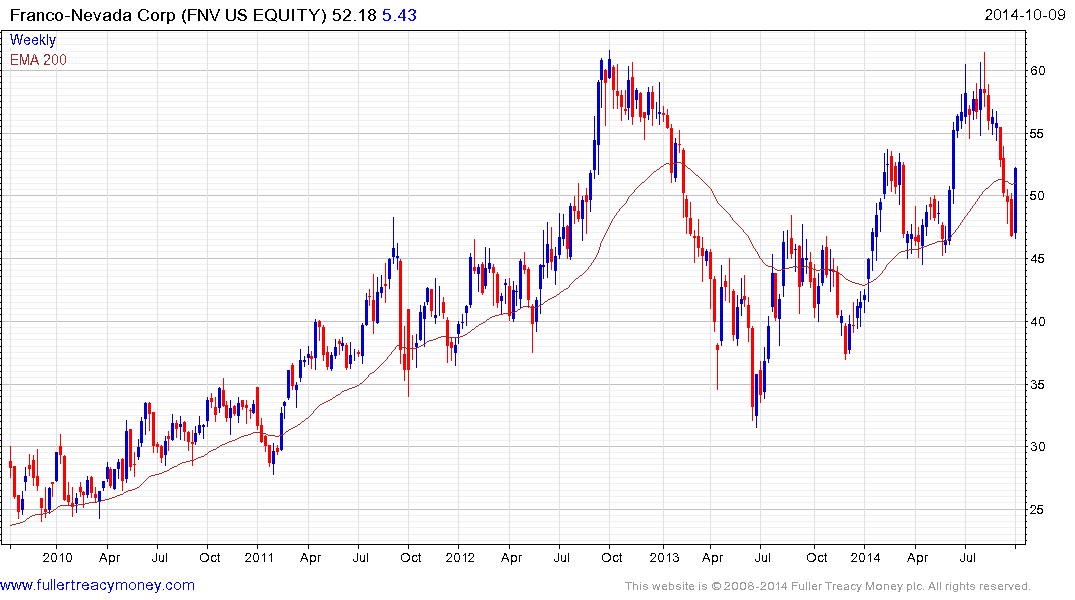

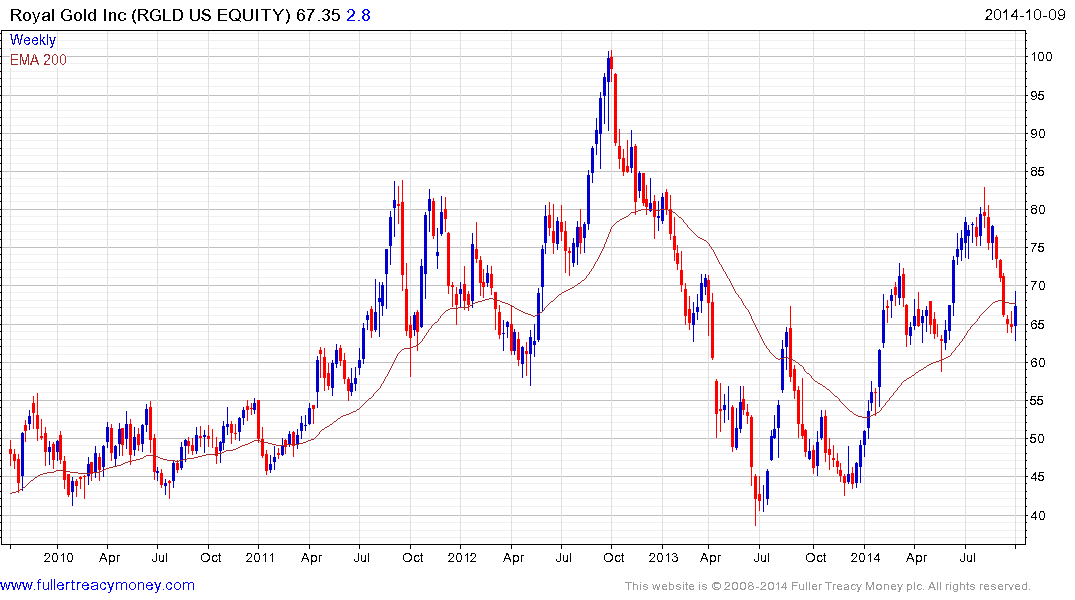

Royalty streamers such as Franco Nevada and Royal Gold found support in the region of their respective 200-day MAs and can generally book a lower all cost of production than miners.

Eldorado Gold found support this week for the first time in nearly two years.

Sibanye Gold also found support this week in the region of its 200-day MA.

Back to top