Musings From the Oil Patch October 2014

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB. Here is a section on exploration and development budgets:

We continue to see oil companies cut spending by cancelling drilling projects, releasing offshore drilling rigs, reducing headcounts, highgrading drilling prospects and selling or trading assets and acreage. The E&P industry needs to boost its returns and without higher commodity prices managements have little choice but to reign-in their spending. That means more of the steps enumerated above, but it also means improving internal efficiencies and focusing on overlooked opportunities. One of these opportunities may be increasing recovery rates from existing fields and scooping up oil that may be missed in transportation and refining operations. One business that will benefit from this trend is production chemicals. It is one oilfield industry sector currently receiving a high level of attention from private equity investors as well as strategic buyers.

Here is a link to the full report.

The cutting off of Russia from the global market has been a major headwind for the oil services sector quite apart from the declining exploration budgets of major oil producers. Major oil companies have a hard time justifying increased spending on development and exploration when oil prices are weak. Since oil drillers depend on the largesse of oil companies and have benefitted in particular from the constant need to drill associated with unconventional oil and gas, they are also being affected by this transition.

In the oil machinery/equipment sector companies such as Weir Group (Est P/E 16.15, DY 2.34%) have been trending higher in a choppy fashion for the last three years. The share has pulled back sharply over the last few weeks. A deep short-term oversold condition is developing but a clear upward dynamic will be required to signal a return to demand dominance as the medium-term progression of higher reaction lows, currently near 2000p, is approached.

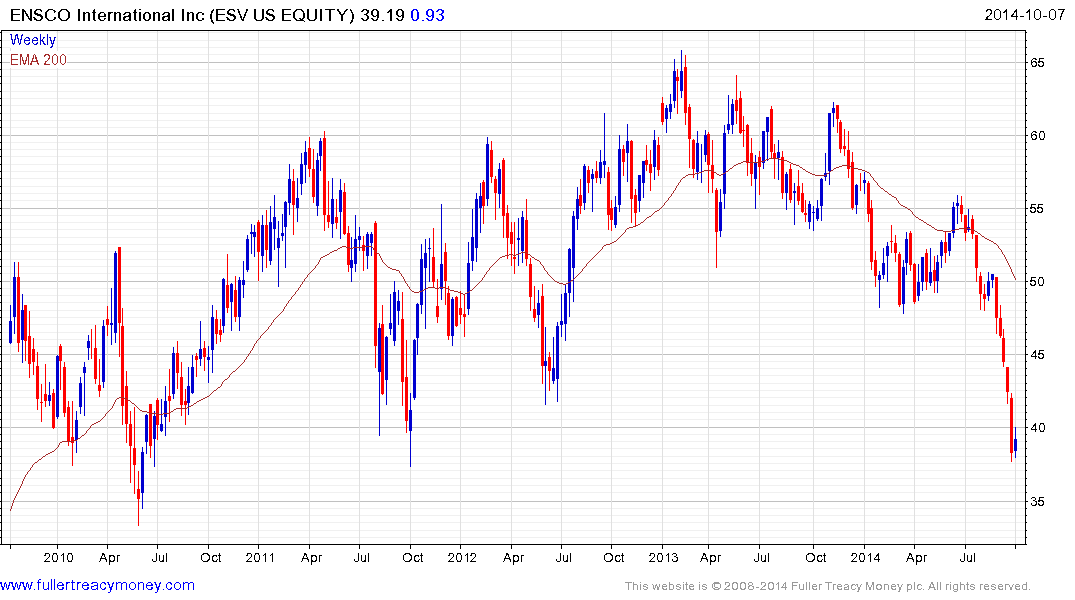

A number of companies in the drilling sector have also experienced some major trend inconsistencies and short-term oversold conditions are evident. The hammer has fallen particularly hard on companies with an offshore focus. For example, Ensco Plc (Est P/E 6.79, DY 7.58%) fell for five consecutive weeks to test the 2011 lows near $40. Even if one were to assume an even more bearish medium-term outcome there is room for a reversionary rally as investors are enticed by low valuations in the short term.

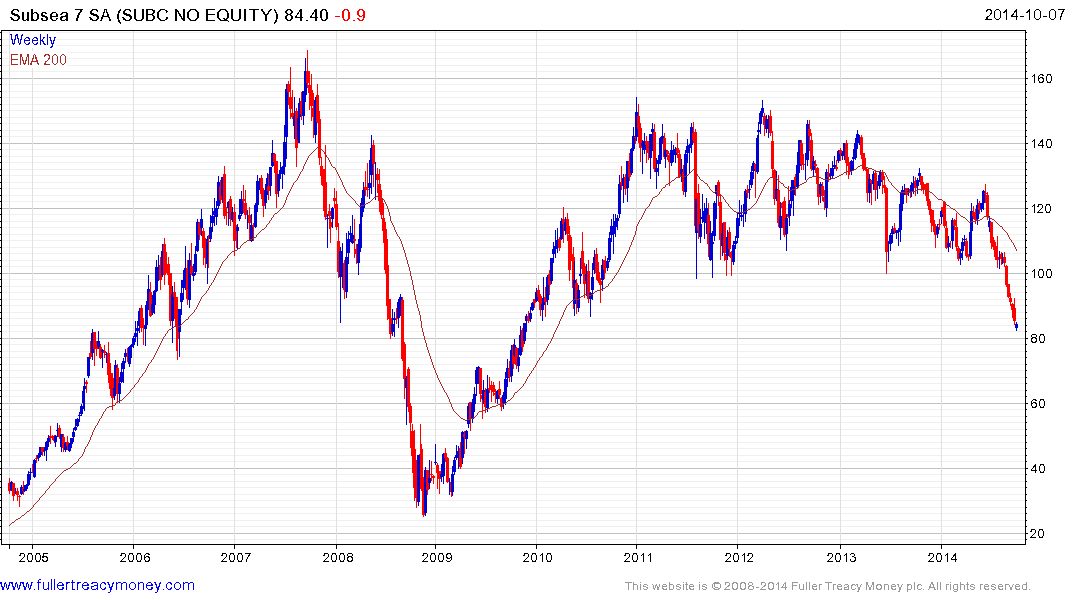

Norwegian listed Subsea 7 (Est P/E 6.57, DY 4.27%) dropped to new three-year lows last week. It also has room for some steadying but a sustained move above NOK100 will be required to begin to repair confidence beyond scope for some short-term steadying.

For some companies such as McDermott International the decline has been such that the prospect of M&A activity is becoming attractive. Russia is almost certainly under a great deal of pressure from the removal of access to advanced drilling technologies and any change to the macro geopolitical environment is likely to act as a powerful catalyst for the move oversold price charts in the sector.

I have recreated the oil machinery/equipment, drilling and services sections from my Favourites in the Chart Library.

Back to top