My personal portfolio

A position increased.

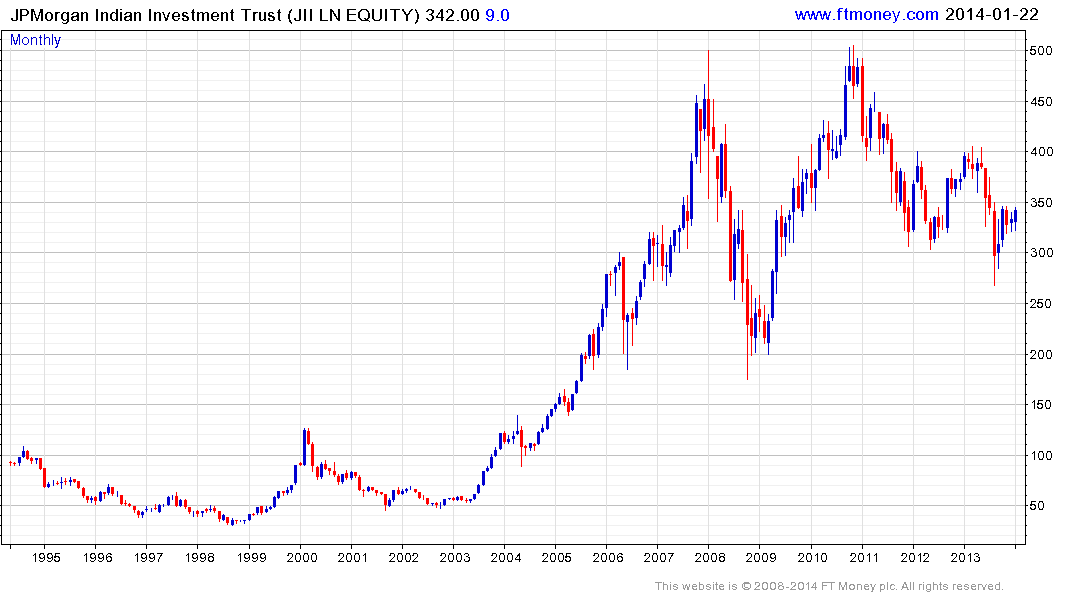

JPMorgan Indian Investment Trust (JII LN) long increased

I have held Sterling-denominated JII in my personal long-term investment portfolio since mid-2003. It has been a frustrating investment since the second peak near 500 in late 2010 because so much went wrong in India, including slower growth, corruption scandals, inflation problems and a weak currency. Fortunately, this has provoked some significant changes which you can read about above, and these are leading to some positive re-ratings for India. JII has underperformed the Sensex Index since 2010 for two reasons: the Indian Rupee’s weakness (shown inversely against the US Dollar) and JII’s discount to NAV which is currently -13.3% according to Bloomberg. This discount will certainly narrow if Modi wins the General Election, as he should, and the Rupee may no longer be a problem now that Rajan is leading the RBI. On Tuesday I increased my long position in JII with a spread-bet. I paid 343.88p for a June contract, including all costs.

Back to top