Convert to Dollars and Watch Overseas Stock Rallies Disappear

This article by Michael P. Regan for Bloomberg highlights the increased need for awareness of currency market volatility and may be of interest to subscribers. Here is a section:

While it hasn’t been a great quarter for stocks around the world, at first blush the national benchmark indexes for developed markets do not look disastrous.

Japan’s Topix is leading the way with an 8 percent gain. Israel’s Tel Aviv 25 Index is almost 5 percent higher, while benchmark gauges from Ireland to the Netherlands to New Zealand have risen more than 2 percent since the end of June. Of 24 developed markets, 13 are up for the quarter.

Here’s a neat parlor trick, however: Convert the indexes to U.S. dollars and almost all of those gains disappear. The U.S. currency has been on a tear, so the Bloomberg Dollar Spot Index is poised for its best quarter in three years with a gain of almost 6 percent. The American currency is stronger against all 16 major peers this quarter. The reasons are well known -- bets that the Federal Reserve will tighten monetary policy with interest rate increases while other central banks stay loose or get looser.

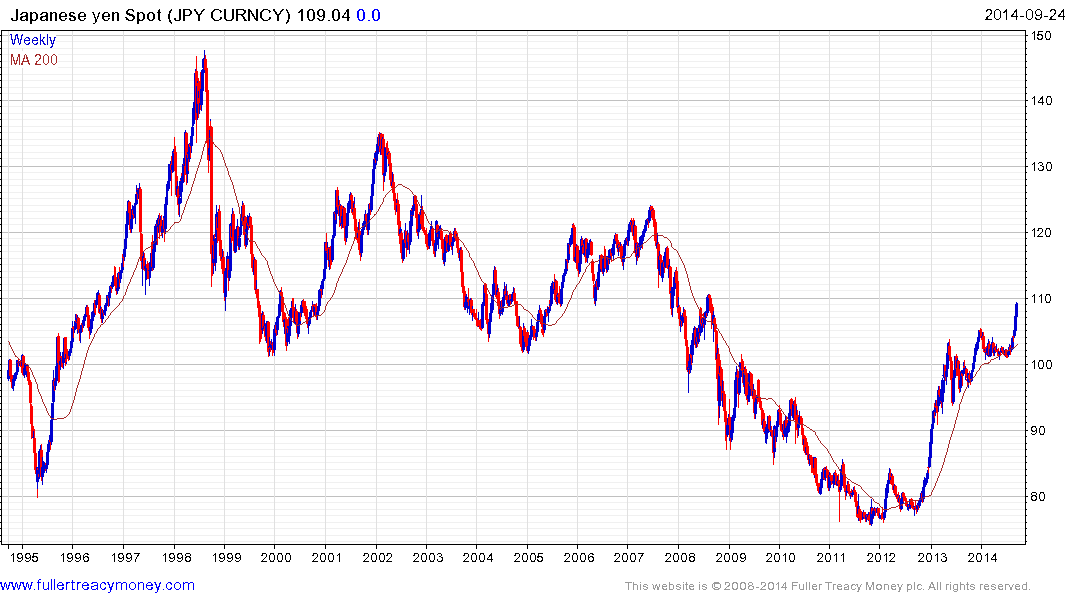

The adoption of quantitative easing by the BoJ at the end of 2012 represented a major change in the status quo between currencies in Asia. Ultimately competitive currency devaluation has been less severe than feared but a higher level of volatility has certainly been evident and a number of central banks were forced to intervene in order to stem declines in their respective currencies that were stoking inflation.

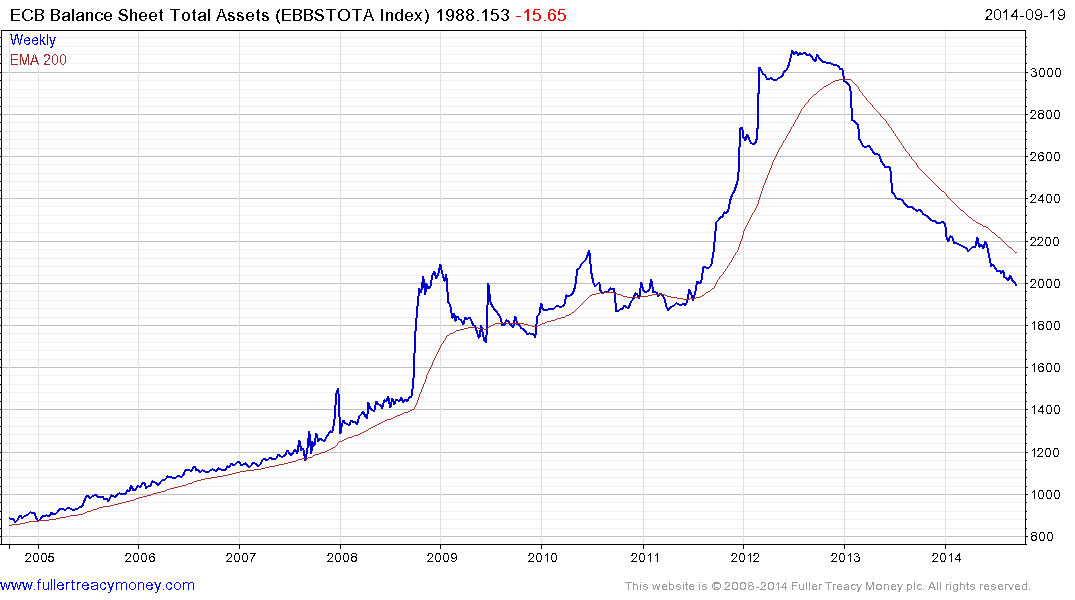

The end of Fed’s QE program represents an additional shake up in the status quo. The ECB has had the luxury of dithering in its monetary policy response to the deflationary pressures evident across much of the Eurozone because the financial sector has had access to abundant liquidity via swap lines with the Fed. It is no coincidence that the end of tapering has resulted in more dovish comments from Mario Draghi.

Since the contraction of the ECB’s balance sheet was one of the primary supports for the value of the Euro, the prospect of it expanding from the current €2 trillion back to the €3 trillion peak of 2012 helps to explain why traders have been selling the currency.

The Dollar has been weak for a long time and this may now be changing as other countries and regions need a weaker currency more. A quick look at the historical chart of the Dollar/Deutsche Mark (the historic Euro chart) illustrates just how weak the Dollar has been and that Type-2 base formation characteristics are evident over the last five years.

One of the most attractive characteristics of the emerging markets from the early 2000s was the relative strength of their currencies. A foreign investor had the benefit of capital market and currency market appreciation or yield compression in the bond markets.

The US Trade Weighted Real Other Important Trading Partners Dollar Index is updated monthly and composed of “Mexico, China, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Thailand, Philippines, Indonesia, India, Israel, Saudi Arabia, Russia, Argentina, Venezuela, Chile, and Columbia.” The secular decline lost momentum from late 2011 and it would not be surprising if the Index breaks back above the 200-day MA when it is next updated at the end of September.

The Dollar Index might be somewhat overbought in the short term but the case for medium-term demand dominance is becoming increasingly credible.