Potash Market Rebound in 'Full Force' as Global Demand Improves

This article by Jen Skerritt for Bloomberg may be of interest to subscribers. Here is a section:

Potash prices are recovering after a decade of weakness, lifting the prospects of a turnaround in fortunes for fertilizer companies following a slump in farm spending.

Potash Corp. of Saskatchewan Inc., the world’s second- biggest producer, boosted its full-year earnings forecast on Thursday and said strong demand will continue for the rest of the year as North American farmers seek to replenish soil nutrients after record harvests. Chinese potash shipments are expected to increase in 2017, it added.

The Canadian company’s performance suggests the potash recovery is in “full force," Sanford C. Bernstein & Co. analyst Jonas Oxgaard said in a note. Canpotex -- the joint venture handling overseas sales for Potash Corp. and its two largest North American peers, Agrium Inc. and Mosaic Co. -- has kept the market tight and driven up prices, while volumes have exceeded expectations in North America and export markets, a positive sign for the companies, he said.

“I think we’ve seen the turnaround already,” Oxgaard said by phone. “We expect continued price increases in potash.”

Potash Corp. maintained its forecast for worldwide industry potash shipments of as much as 64 million metric tons this year, up from 60 million in 2016. It raised its prediction for Latin American shipments. China, the largest market, is now seen consuming as much as 15.5 million tons.

The most important thing that happened in the potash market in the last decade was Uralkali’s attempt to reassert its dominance on the market by massively increasingly supply when it broke its relationship with Belaruskali in 2013. More than any other factor that contributed to the collapse in pricing.

News from June last year that they might be willing to rejoin the global cartel was the first sign the bitter dispute between some of the oligarchy’s largest producers was thawing. That helped prices stabilise but there is little evidence yet that a recovery is underway.

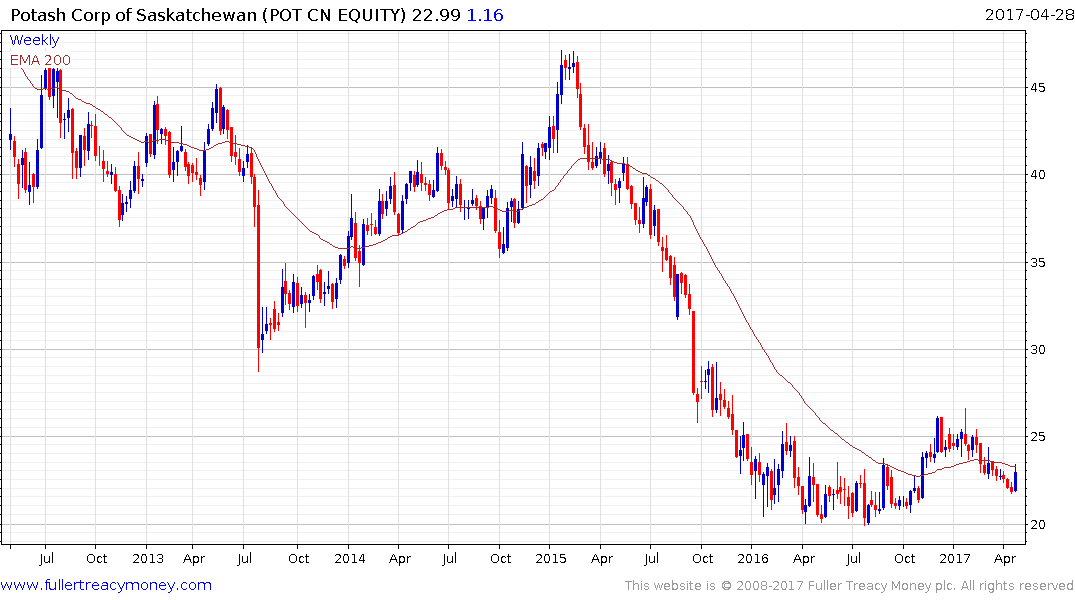

Potash Corp of Saskatchewan returned to test the region of the 2016 lows from early this year and firmed this week to confirm at least near-term support. Upside follow through next week would suggest more than short-term steadying.

The Global X Fertiliser/Potash ETF holds substantially more than potash companies and bounced this week from the region of the upper side of the underlying range and the region of the trend mean. A sustained move below $9 would be required to question recovery potential.

Australian listed Nufarm, produces pesticides and is one of the ETFs best performers this year. It broke out of a four-year base in 2015, completed a first step above it in September and continues to trend higher.