Putin Arouses European Tank Ambitions Dormant Since Cold

This article by Richard Weiss for Bloomberg may be of interest to subscribers. Here is a section:

Polish President Bronislaw Komorowski said last week that the Ukraine crisis has shattered the illusion that force no longer has a role in European politics. The North Atlantic Treaty Organization must station troops on its eastern flank and halt cuts after Russia boosted its defense outlay for eight straight years, he said at the Army Day parade in Warsaw attended by military representatives of the U.S. and Canada.

Finnish President Sauli Niinistoe met with Putin on Aug. 15 for talks about the escalating tensions after saying the world was on the brink of a new Cold War. Finland has a longer land border with Russia than the rest of the European Union combined.

Latvia will also seek to bolster Baltic defenses when a delegation meets with German Chancellor Angela Merkel today, according to comments from the country’s defense ministry.

In Russia, the T-90 tank remains in high production, with almost 1,700 built and a successor, the T-99, in development.

Relations between Russia and Ukraine remains tense, with little trust between the sides to help bolster faith that negotiations will be worthwhile. One can imagine what conversations are going on in the council chambers of Eastern European democracies and the conclusion has to be that defences need to be beefed up.

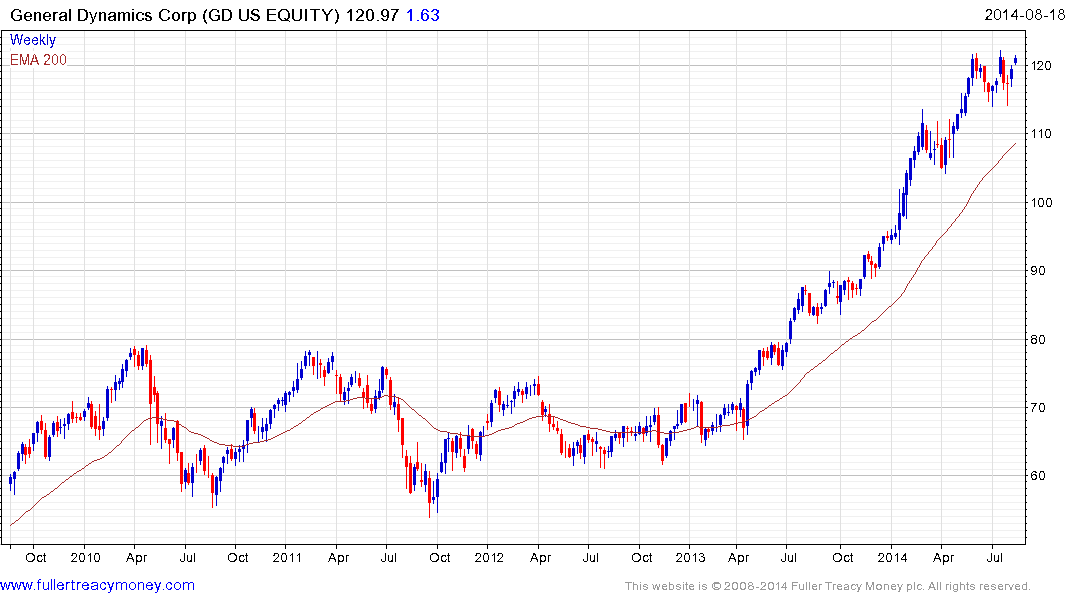

General Dynamics (Est P/E 16.08, DY 2.05%) completed a three-year base in 2013 and remains in a consistent medium-term uptrend. It has been consolidating in the region of $120 since June and a sustained move below $110 would be required to begin to question upside potential.

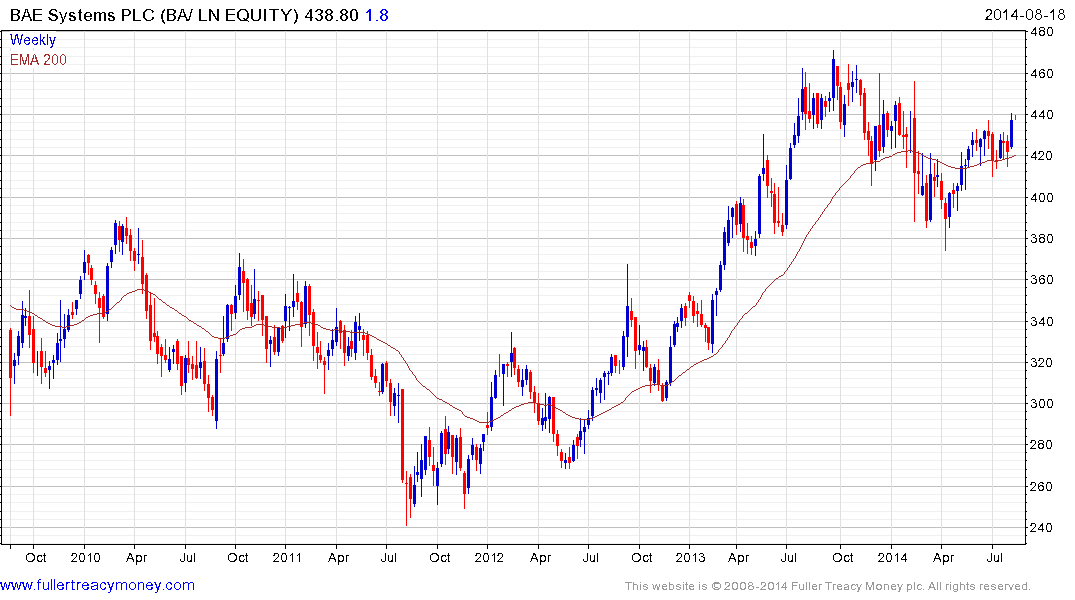

BAE Systems (Est P/E 11.46, DY 5.14%) rallied from its April low to consolidate above the 200-day MA and broke the medium-term progression of lower rally highs last week. A sustained move below 420p would be required to question medium-term scope for continued upside.

Rheinmetall (Est P/E 13.73, DY 0.98%) dropped abruptly as the extent of the loss of its Russian contracts became apparent, but it has at least steadied in the region of €40 and potential for a relief rally has increased.

Finmeccanica (Est P/E 29.57) continues to form a first step above its base and a break in the progression of higher reaction lows would be required to question medium-term recovery potential.

Back to top