Quantitative Tightening as $12 Trillion Reserves Fall

This article by Simon Kennedy for Bloomberg may be of interest to subscribers. Here is a section:

They predict 2015 will mark the peak of reserve accumulation after two decades of growth with China in the vanguard as its new currency regime means it has to pare reserves to avoid a freefall in the yuan. It has already reduced its holdings to $3.65 trillion from $3.99 trillion in 2014.

For markets, Deutsche Bank says less reserve accumulation should mean higher bond yields and a rising dollar against rivals including the euro and yen. There are implications too for other central banks if the resulting rise in market borrowing costs hampers their ability to tighten monetary policy.

“This force is likely to be a persistent headwind towards developed market central banks’ exit from unconventional policy in coming years, representing an additional source of uncertainty in the global economy,” Saravelos and colleagues in a report to clients on Tuesday. “The path to ‘normalization’ will likely remain slow and fraught with difficulty.”

The rout in emerging markets currencies has created a quandary for their respective central banks. In the last decade, buying US dollars was seen as a way of delaying the rise of emerging currencies against a background of a weak US Dollar and strong inflows. Today if they buy US Dollar’s their currencies would accelerate lower and fears of true economic stress would surge. As a result they are forced to stop accumulating reserves to support their currencies in an effort to stem the exit of foreign capital.

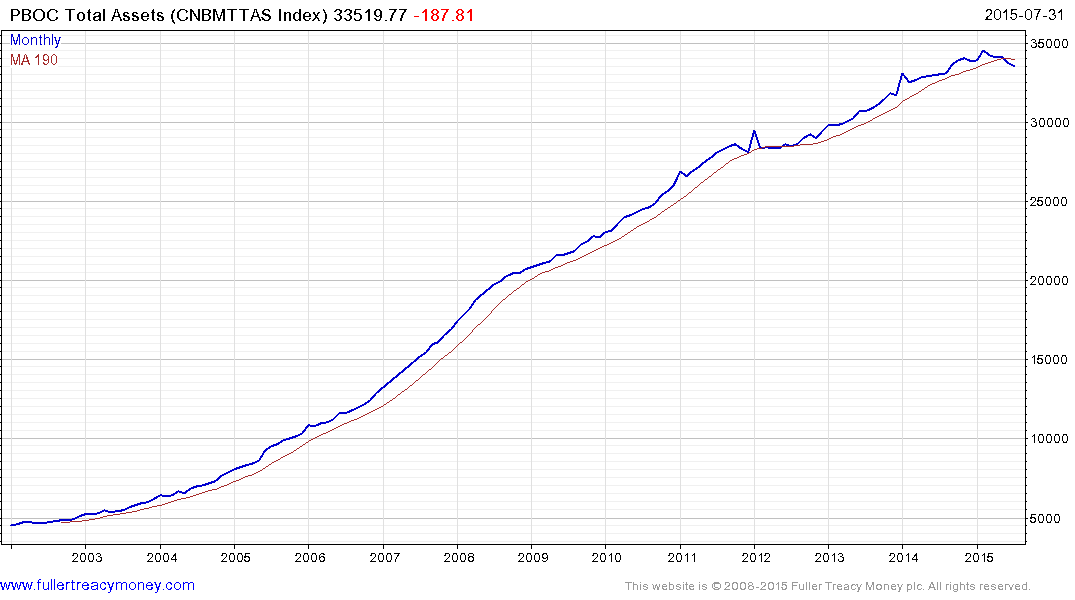

Japan’s decision to adopt QE set off a wave of competitive devaluations across Asia and China’s recent devaluation has had a similar effect. The PBoC’s Total Assets have pulled back somewhat over the last six months to break a long progression of higher reaction lows. Reserves of $3.5 trillion still represent the largest pile of capital on earth so the central bank has ample firepower, but it is looking increasingly likely the long trend of reserve accumulation is over.

Some deep oversold conditions are developing which suggest a reversionary rally is increasingly likely. However, evidence of support building will probably be required to entice foreign buyers back in.

The Asia Dollar Index has steadied in the first couple of days of this week but more will be required to signal a return to demand dominance beyond short-term steadying.

It is also worth considering that since the decline in currencies has been a catalyst for selling pressure, the eventually bottoming of emerging market currencies will represent a renewal of their competitive edge and a favourable entry point for medium-term investors.

Back to top