Ronald-Peter Stöferle: Special Gold Report

Gold is a highly emotional topic. It seems there are only two opposing fronts here: people who love gold (aka gold bugs), and people who hate it. There are only very few shades of grey between these two fronts, and people are extremely hesitant to defect from one to the other. It seems as if we were faced with something like "aurophobia", especially in the financial sector. This pathological fear of, or aggression towards, gold does not seem to exist for any other commodity. After all, we have not heard of such a profound aversion against copper, we do not know "bond haters", nor are militant property bashers a popular concept. We regard ourselves as analysts rather than psychotherapists, which is why we do not really want to dwell on the reasons for that strong aversion. Instead we would like to continue substantiating with data, historical comparisons, and facts why we believe that gold should be a central module of the portfolio.

And on the USA's debt ceiling:

The quarrels over the debt ceiling will probably only be sorted out shortly before 2 August because we are looking at a political power game here. There seems to be no doubt about the fact that the ceiling will be raised, as a look back into history shows. The debt ceiling, or debt limit, was introduced in 1917 and fixed at USD 11.5bn. Since then it has been raised 93 times, and the momentum seems to be accelerating. Since 1962 it has been raised 74 times, and since 2001 ten times already. It therefore makes sense to question the point of such a limit* altogether.

(*From "False Belief #3: There is a Debt Ceiling", Louis Boulanger, The Gold Standard Institute Magazine Journal, April 2011)

And on sound money:

The possession of gold is tantamount to pure ownership without liabilities. This also explains why it does not pay any ongoing interest: it does not contain any counterpart risk. Along with the International Exchange and the Chicago Mercantile Exchange, JPMorgan now also accepts gold as collateral. The European Commission for Economic and Monetary Affairs

has also decided to accept the gold reserves of its member states as additionally lodged collateral. We also regard the most recent initiatives in Utah and in numerous other States as well as in Malaysia, and the planned remonaterisation of silver in Mexico as a clear sign of the times. The foundation of a return to "sound money" seems to have been laid.

And on extrapolation of the past:

Even though critics will not tire of discrediting gold as the barbarous relic and yesterday's money that has no place in modern society, we would like to ask the question what timeline they have looked at. "Natural laws" such as "property prices don't

fall", "US Treasuries are risk-free", or "The Earth is flat" may have applied in the (recent) past, but if we broaden the (time) horizon, we find that the picture changes. The mere extrapolation of the past leads to disastrous results in the long term. Gold on the other hand has a track record of 6000 years as the currency of last resort and has never turned worthless.

David Fuller's view Fullermoney has posted or provided excerpts

from dozens of gold reports over the last decade. A search of Fullermoney's

Archive for gold shows that it has been mentioned 1680 times since this

became a fully online service in 2004. And we do not consider ourselves gold

bugs, although we recognize its unsurpassed monetary role for millennia. We

can also recognize a secular trend and have pointed out since at least 2005

that gold was steadily being remonetised

in the eyes of investors.

For those of us who think we know almost everything that is relevant about gold

in the context of today's monetary system, think again. I am learning a lot

from this report, not least from the superb graphics. There are also some superb

quotes which I had either not seen or forgotten, and wish to keep in mind.

For those

who want a definitive study of gold's relevance today, Ronald-Peter Stöferle

provides it in this report which I could not recommend more highly. I would

also give it to your adult children, as I intend to do. For those in a hurry,

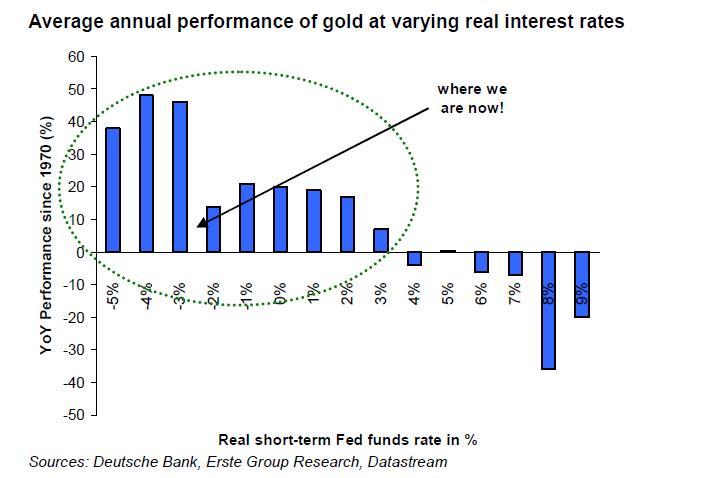

read the conclusion first, as I did. It also contains this graphic which I had

not seen before. It probably gives us a better indication of medium-term potential

versus risks than anything I have seen previously.

This

graphic showing the "Average annual performance of gold at varying real

interest rates", is the best single quantifier of medium to longer-term

risk that we are likely to see - one to print out and keep in your portfolio

notes.

Fullermoney

has long maintained that it would be higher interest rates that will eventually

end gold bullion's secular bull market. Needless to say, we are nowhere near

that level today, although real (inflation adjusted) rates are higher in some

countries.

Currently,

gold bullion in USD (monthly, weekly & daily) is continuing its correction

and seasonal consolidation since its early-May peak. This has gold a long way

towards the successful mean reversion relative to the 200-day moving average

which we have discussed on so many occasions.

Interesting,

gold has reached a seasonal/consolidation low in July of the two previous years.

To see this precisely, bring up a weekly chart of gold bullion (golds) in the

Library, click on the 'Tracking On' link in the charcoal toolbar and hold the

cursor over the previous July lows. Gold reached a six-week low last Friday.

The prospects of a July low have probably improved with the stock market rally

as this reduces the risk of contagion selling.

Gold

remains on course for seasonal strength in September, if not sooner.