Saudi Arabias Naimi Says OPEC Meeting Can Wait as Oil Slumps

This article by Wael Mahdi and Maher Chmaytelli for Bloomberg may be of interest to subscribers. Here is a section:

Saudi Arabia, the world’s biggest crude exporter, said OPEC doesn’t need to meet on possible measures to check falling oil prices, according to the kingdom’s oil minister Ali Al-Naimi.

Prices “always fluctuate and this is normal,” Naimi told reporters in Kuwait where he’s meeting counterparts from the Gulf Cooperation Council comprising six Arab oil-producing monarchies. Four of them -- Saudi Arabia, Kuwait, the United Arab Emirates and Qatar -- are members of the Organization of Petroleum Exporting Countries.

OPEC is coming under pressure to pump less crude as increased output from U.S. shale deposits is pushing prices to a 16-month low, according to a Citigroup report Sept. 8. Saudi Arabia cut its production by 408,000 barrels a day in August, to 9.6 million barrels, according to its submission to OPEC’s monthly oil market report published yesterday.

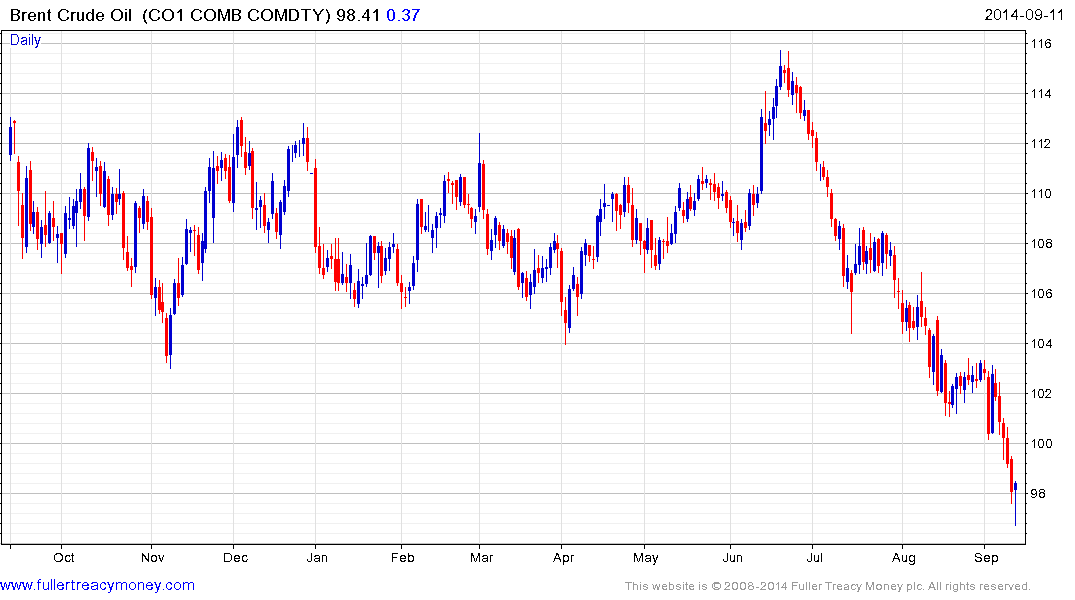

Brent, the benchmark for more than half the world’s crude, fell under $100 a barrel on Sept. 9 and was trading today at $97.56 a barrel at 9:44 a.m. in London.

“It’s too early now,” Naimi said in response to a question about whether OPEC would convene before its next scheduled meeting on Nov. 27. “We will discuss the prices and the production level when in our next group meeting.”

Saudi Arabia’s output reduction came as other OPEC members such as Nigeria and Kuwait said they increased output, according to the group’s oil market report. Total production by the organization’s 12 members climbed by 231,000 barrels a day to 30.347 million last month, based on secondary sources, the report showed.

?OPEC, which supplies 40 percent of the world’s oil, reaffirmed its output target at 30 million barrels a day when it last met in June.

As the global swing producer, Saudi Arabia’s perspective on global oil prices is particularly poignant as Brent crude tests the lower side of a four-year range. They may adopt the perspective that maintaining production is best advised when uncertainty in Syria and Iraq remains so high and sanctions risk pressuring Russian exports, They might conclude they need the money and attempt to support high prices. Additionally they might conclude the USA’s surging production is a threat to their position so lower prices would help protect that status by pressuring higher cost producers.

I believe the first of the above alternatives is the most likely scenario at least for the moment. With such a deep short-term oversold condition evident we can conclude that there are some large short positions in Brent crude. However, a clear upward dynamic will be required to pressure stops, initiate margin calls and fuel a rebound. Additional sanctions on Russia might represent a catalyst

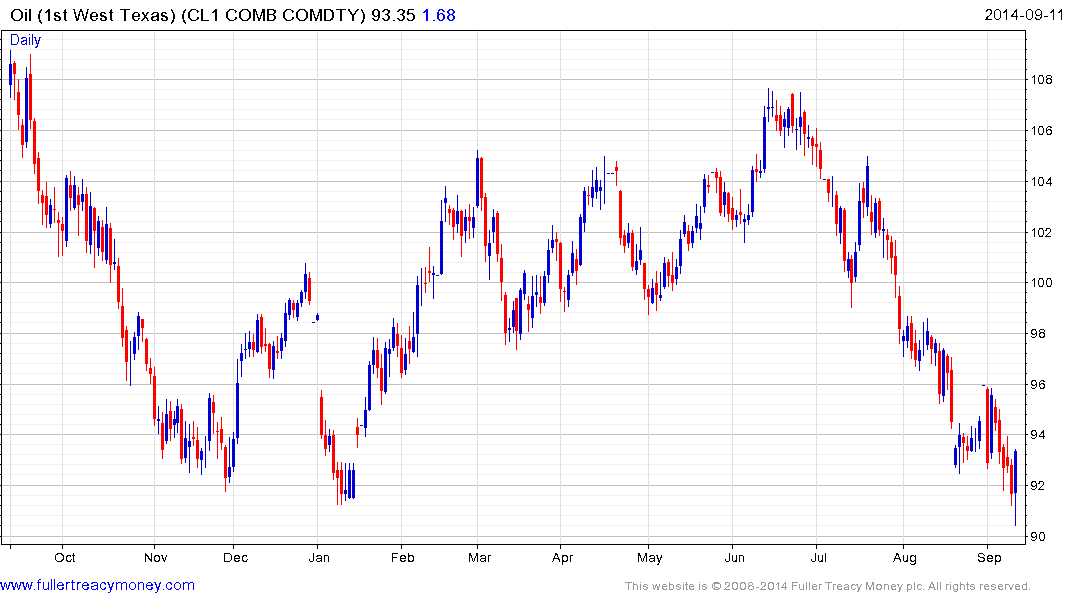

West Texas Intermediate posted an upside key day reversal today and some additional follow through tomorrow would increase potential that more than a short-term low has been reached.

Back to top