Singapore and Japan trip report

It was a personal pleasure to meet up with subscribers on this trip to both Singapore and Japan but also educative to get on-the-ground intelligence for how these markets are doing.

Singapore’s chilli crab and Hainanese chicken and rice are as good as ever but a bubbling sense of discontent is increasingly evident among taxi drivers in particular. Historically taxi drivers have been akin to ambassadors for the country since the government correctly identified them as the first point of contact many foreigners have with Singapore. Today they feel ill-treated by an administration which has allowed Uber access to the market, while Temasek is funding GrabCar. The traditional taxi service is under pressure as a result not least because many people view driving for Uber as the only way they could possibly afford a car.

The one phrase that I did not expect to hear in Singapore but which more than a few people talked about was “legalised corruption”. The last time I was in Singapore a few years ago, the government sent everyone a S$200 gift (hung bao) ahead of the election to none too subtly buy votes. Shortly after the election they raised the price of water which raised costs for everyone and by substantially more than the S$200 “gift”.

Lee Hsien Loong, Lee Kwan Yew’s son is prime minister and his wife Ho Ching is CEO at Temasek. That concentrates a great deal of power in the hands of the ruling family. Changes to how the largely ceremonial Presidential position can be contested now ensure that only someone of Malay ethnicity can contest the election. Quite apart from disqualifying Tan Cheng Bock from the race this represents a clear challenge to the premise on which the state was founded which was to ignore national origin so that all might be equal within Singapore.

I have a deep sense of affection for Singapore, its people and the success the country has achieved. However I was surprised by the depth of discontent I encountered. In a year where political populism has been such a theme, the next Singaporean parliamentary elections are likely to be hotly contested.

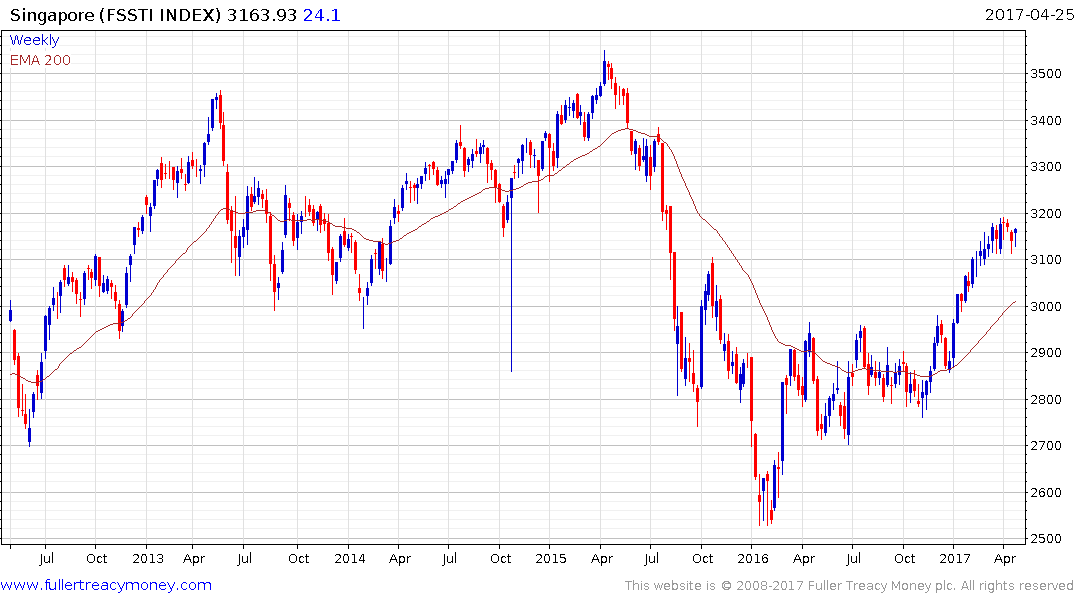

The stock market Index has been ranging between 2600 and 3400 since 2011 and is currently rallying from the lower boundary. A sustained move below 3000 would be required to question medium-term scope for additional higher to lateral ranging.

The US Dollar encountered resistance against the Singapore Dollar near $1.45 in January and has returned to test the region of the trend mean. A clear upward dynamic will be required to confirm support in this area. Medium-term the range, which has been developing between S$1.30 and S$1.45, has first step above the base characteristics.

This was my first time to Japan and we spent the majority of our time in Tokyo. Some of the sushi restaurants we sampled were nothing short of sublime and I can say without reservation that Tokyo offers some of the best and most affordable dining options in the world.

To get a closer insight into Japanese living and because hotel rooms are notoriously small we stayed at an Airbnb apartment. This was not our first time using the service and as with other occasions it was largely seamless, resulted in a better solution for our family and was very cost effective.

My daughters dived right into the pop art culture of anime, Pokémon, maid, owl, hedgehog and cat cafés and had a blast. For Mrs. Treacy the bidet toilet seats and domestic cosmetics only available in Japan, restaurants and cherry blossoms were the primary draw. The number of Chinese tourists with similar priorities is quite impressive and highlights how much of a boom the tourist sector is currently enjoying.

My immediate impression was that the rigours of a decades-long deflation have taken a toll on animal spirits. The malls are full which is in sharp contrast to the USA but I wonder if this is because home spaces are small and the majority of socialising is done outside? I saw a lot of people shopping but it really only appeared to be tourists buying.

The conservativism which characterises the Japanese culture highlights just how acute the need for reform is. Abenomics remains an incomplete solution and some of the most aggressive reforms have yet to be passed. Meanwhile the Dollar is strengthening once more from the ¥110 level and the Yen’s inverse correlation with the Nikkei-225 continues to act as a tailwind.

The Nikkei-225 bounced last week from the region of the trend mean and followed through on the upside this week. A sustained move below 18,000 would now be required to question medium-term scope for additional upside.