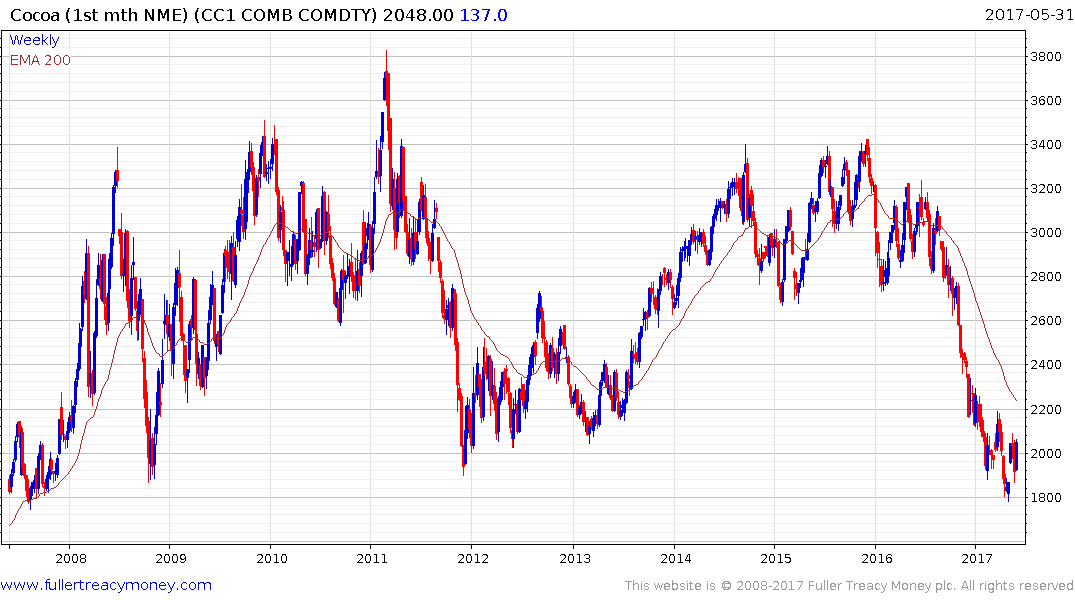

The End of Cheap Chocolate? Cocoa Futures Surge Most on Record

This article by Marvin G Perez for Bloomberg may be of interest to subscribers. Here is a section:

Ivory Coast growers have sold 950,000 tons of cocoa beans from the 2017-18 main crop as of May 27, according to a person familiar with the matter. The main crop, which starts Oct. 1, is the larger of the country’s two annual harvests.

“That’s a pretty big upfront sale, and it’s probably the reason why prices are rallying,” Jack Scoville, vice president for Price Futures Group in Chicago, said in a telephone interview.

Some growing regions in Ivory Coast and Ghana, the second-largest producer, have been dry and need moisture to aid early crop growth, according to Gaithersburg, Maryland-based MDA Weather Services. Trees are also stressed from a lack of moisture in Indonesia’s Sulawesi region.

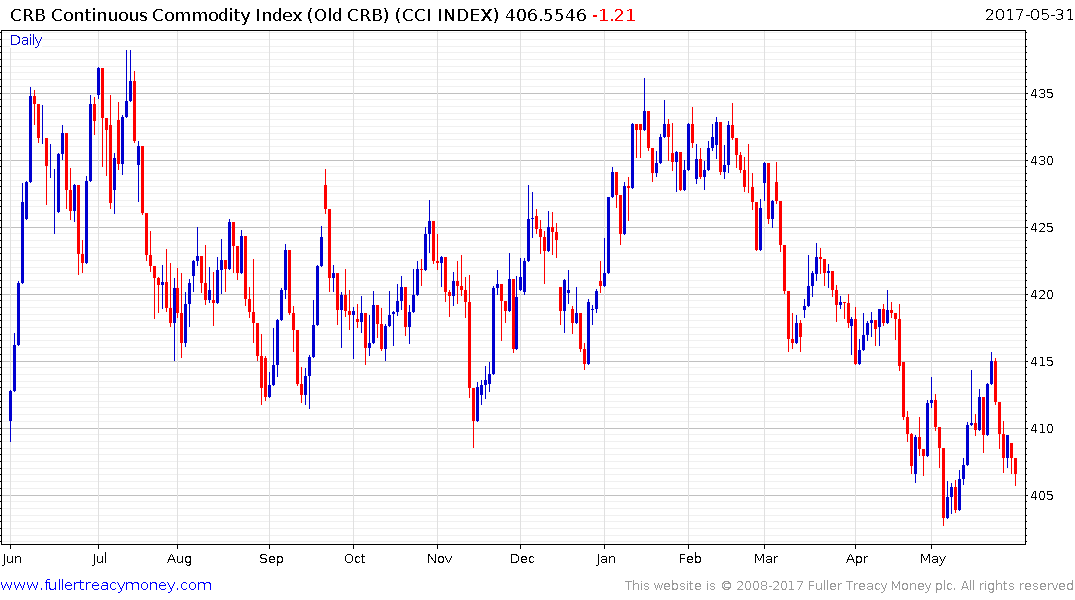

There has been a great deal of diversity in the performance of individual commodities but weakness in the agricultural sector has been a primary contributor to the underperformance of the Continuous Commodity Index. The abrupt decline in energy prices has been a more recent factor. Nevertheless there is now some diversity coming into the agricultural sector which suggests they need to be treated on their individual merits.

Cocoa’s downtrend has lost momentum in the region of the 2008 and 2012 through 2013 lows. A reversionary rally appears to be underway but a sustained move above the trend mean would be required to confirm more than temporary steadying in this area.

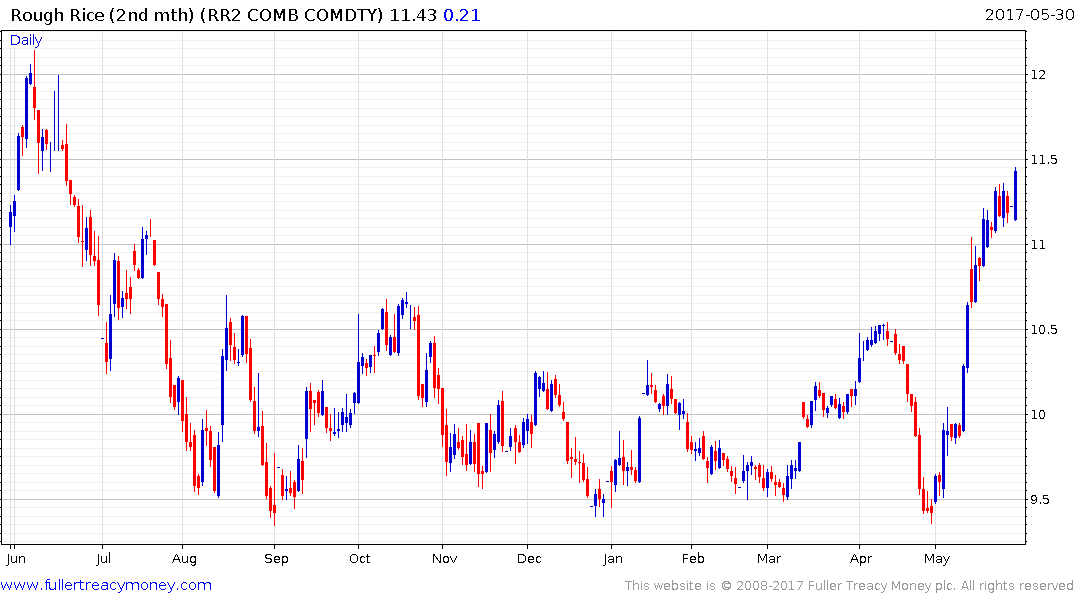

Rough Rice continues to benefit from the damage done to the US crop by flooding and broke out of a short-term range yesterday to extend its rebound.