US fiscal conservatives come out fighting

Congress is currently embroiled in a funding fight over how much to spend on less than one-fifth of the federal budget for the next six months. Whether we cut $33 billion or $61 billion-that is, whether we shave 2% or 4% off of this year's deficit-is important. It's a sign that the election did in fact change the debate in Washington from how much we should spend to how much spending we should cut.

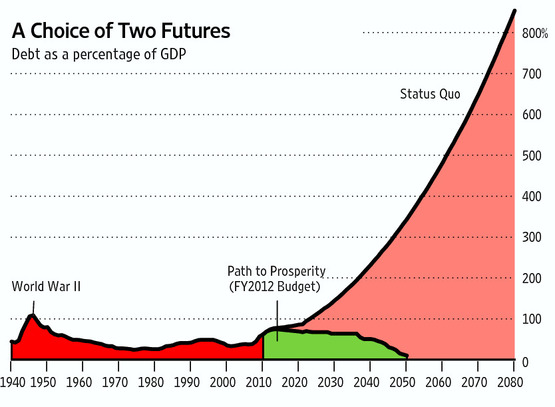

But this morning the new House Republican majority will introduce a budget that moves the debate from billions in spending cuts to trillions. America is facing a defining moment. The threat posed by our monumental debt will damage our country in profound ways, unless we act.

No one person or party is responsible for the looming crisis. Yet the facts are clear: Since President Obama took office, our problems have gotten worse. Major spending increases have failed to deliver promised jobs. The safety net for the poor is coming apart at the seams. Government health and retirement programs are growing at unsustainable rates. The new health-care law is a fiscal train wreck. And a complex, inefficient tax code is holding back American families and businesses.

David Fuller's view The famed hockey stick is back in this dramatic graph projecting the status quo.

The GOP budget aims to cut $6.2 trillion in spending over the next 10 years by addressing five key areas: 1) Reducing spending; 2) Welfare reform; 3) Health and retirement security; 4) Budget enforcement; 5) Tax reform.

This plan will certainly appeal to fiscal conservatives and the USA's creditors, starting with China and Japan. I assume that it will be vehemently opposed by those in the USA who favour a more socialistic form of economic governance.

I also assume that any credible deficit reduction scheme for the USA - which could actually be implemented - would support the USD and keep the all but inevitable rise in US long-dated government bond yields over the next twenty years within reason for a developed economy.

Of course 'the devil is always in the detail' and I would welcome some of the more credible editorial comments - for and against - that this budget outline is certain to invite.