Why Bond Buyers Love That Companies Are Borrowing More Than Ever

This article by Lisa Abramowicz for Bloomberg may be of interest to subscribers. Here is a section:

Balance sheets are also getting better, with companies improving their profitability faster than they’re borrowing.

Gross leverage ratios for the average investment-grade issuer fell to 2.58 times in the first quarter from 2.59 times at the end of the year, according to Morgan Stanley data measuring total debt to earnings before interest, taxes, depreciation and amortization. That’s down from 2.73 times in 2009.

Federal Reserve Chair Janet Yellen is fueling the debt party by making it clear that she’s planning to hold benchmark rates low for a prolonged period.

And even though the amount of outstanding investment-grade bonds in the U.S. has ballooned by almost $1.6 trillion since 2008, some of that growth has stemmed from companies shifting into longer-term bonds and out of shorter-term commercial paper, Barclays Plc strategists led by Jeffrey Meli noted in a report today.

Maybe investors shouldn’t be too complacent because equations will change when benchmark yields rise, making it more costly for companies to borrow.

Also, they’re getting paid less and less to own the bonds.

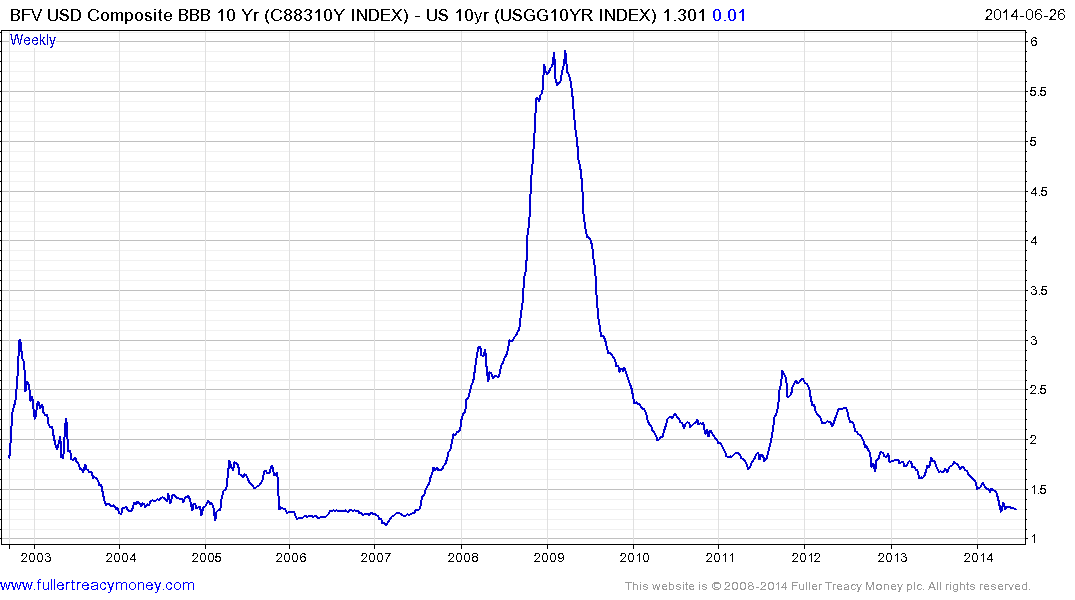

The spread of BBB USD Corporates over Treasuries is almost back to where it was in 2007 at 130 basis points. Taken in isolation this tells us that demand for bonds is at least on par with where it was in the pre-credit crisis era. When we also factor in that on an absolute basis, the yield on offer for BBB bonds is at least 200 basis points lower than in 2007, the attraction of borrowing as much as possible is obvious.

Bond investors have been forced to make purchases in the desire to capture yield and also because the asset class continues to perform. However with the Fed talking about beginning to raise interest rates from next year, the time when borrowers can capture such low rates is getting increasingly short.

.png)

In absolute terms BBB yield broke their downtrend last year and a sustained move below 3.5% would be required to reassert overall demand dominance.

When companies eventually conclude that the fountain of abundant credit they have been borrowing from is less attractive, the uses to which they have been putting this credit such as share buybacks will also come under pressure.

Back to top