Worldwide Threat Assessment of the US Intelligence Community

Thanks to a subscriber for this report which may be of interest. Here is a section on space:

Continued global space industry expansion will further extend space-enabled capabilities and space situational awareness to nation-state, nonstate, and commercial space actors in the coming years, enabled by the increased availability of technology, private-sector investment, and growing international partnerships for shared production and operation. All actors will increasingly have access to space-derived information services, such as imagery, weather, communications, and positioning, navigation, and timing for intelligence, military, scientific, or business purposes. Foreign countries—particularly China and Russia—will continue to expand their space-based reconnaissance, communications, and navigation systems in terms of the numbers of satellites, the breadth of their capability, and the applications for use.

Both Russia and China continue to pursue antisatellite (ASAT) weapons as a means to reduce US and allied military effectiveness. Russia and China aim to have nondestructive and destructive counterspace weapons available for use during a potential future conflict. We assess that, if a future conflict were to occur involving Russia or China, either country would justify attacks against US and allied satellites as necessary to offset any perceived US military advantage derived from military, civil, or commercial space systems. Military reforms in both countries in the past few years indicate an increased focus on establishing operational forces designed to integrate attacks against space systems and services with military operations in other domains.

Russian and Chinese destructive ASAT weapons probably will reach initial operational capability in the next few years. China’s PLA has formed military units and begun initial operational training with counterspace capabilities that it has been developing, such as ground-launched ASAT missiles. Russia probably has a similar class of system in development. Both countries are also advancing directed-energy weapons technologies for the purpose of fielding ASAT weapons that could blind or damage sensitive space-based optical sensors, such as those used for remote sensing or missile defense.

Of particular concern, Russia and China continue to launch “experimental” satellites that conduct sophisticated on-orbit activities, at least some of which are intended to advance counterspace capabilities. Some technologies with peaceful applications—such as satellite inspection, refueling, and repair—can also be used against adversary spacecraft.

Here is a section from the report.

Continued global space industry expansion will further extend space-enabled capabilities and space situational awareness to nation-state, nonstate, and commercial space actors in the coming years, enabled by the increased availability of technology, private-sector investment, and growing international partnerships for shared production and operation. All actors will increasingly have access to space-derived information services, such as imagery, weather, communications, and positioning, navigation, and timing for intelligence, military, scientific, or business purposes. Foreign countries—particularly China and Russia—will continue to expand their space-based reconnaissance, communications, and navigation systems in terms of the numbers of satellites, the breadth of their capability, and the applications for use.

Both Russia and China continue to pursue antisatellite (ASAT) weapons as a means to reduce US and allied military effectiveness. Russia and China aim to have nondestructive and destructive counterspace weapons available for use during a potential future conflict. We assess that, if a future conflict were to occur involving Russia or China, either country would justify attacks against US and allied satellites as necessary to offset any perceived US military advantage derived from military, civil, or commercial space systems. Military reforms in both countries in the past few years indicate an increased focus on establishing operational forces designed to integrate attacks against space systems and services with military operations in other domains.

Russian and Chinese destructive ASAT weapons probably will reach initial operational capability in the next few years. China’s PLA has formed military units and begun initial operational training with counterspace capabilities that it has been developing, such as ground-launched ASAT missiles. Russia probably has a similar class of system in development. Both countries are also advancing directed-energy weapons technologies for the purpose of fielding ASAT weapons that could blind or damage sensitive space-based optical sensors, such as those used for remote sensing or missile defense.

Of particular concern, Russia and China continue to launch “experimental” satellites that conduct sophisticated on-orbit activities, at least some of which are intended to advance counterspace capabilities. Some technologies with peaceful applications—such as satellite inspection, refueling, and repair—can also be used against adversary spacecraft.

Here is a link to the full report.

Satellites represent key pieces of military infrastructure without which many advanced pieces of modern military equipment do not work. Therefore, it is inevitable that space become a theatre in any future conflagration.

China has already demonstrated it is capable of targeting satellites so the counter measure has been to develop nanosatellites; thousands of which can be launched in a single volley to replace lost pieces of infrastructure in a time of crisis. This tit for tat innovation represents the primary argument behind investing in the defense sector since this trend is going to require greater spending.

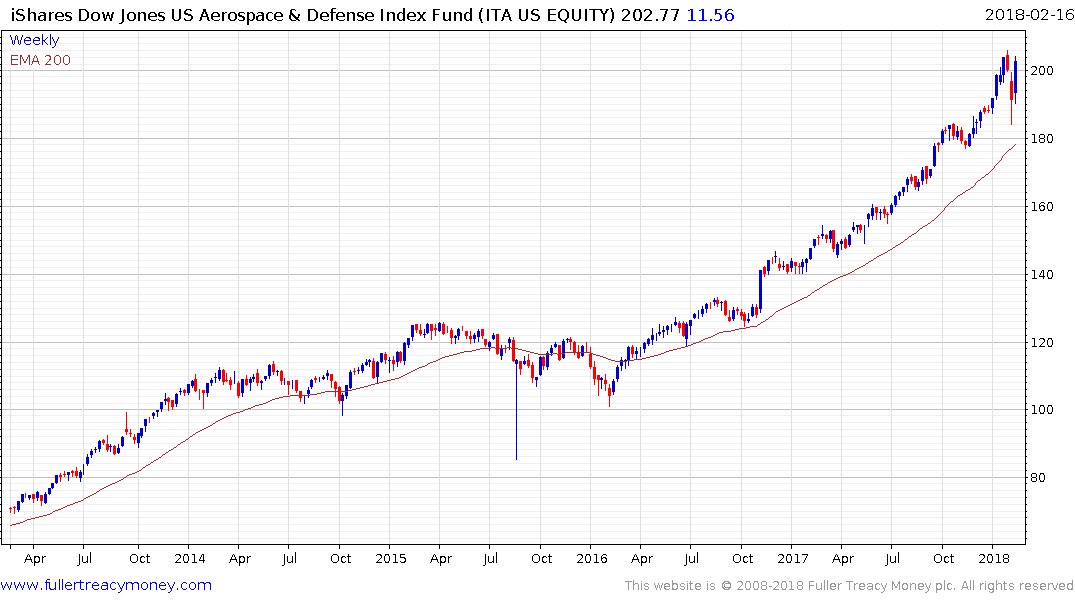

The iShares US Aerospace & Defense ETF has recouped all of last week’s decline and is now back testing its peak. A pause near $205 appears likely but a sustained move below last week’s low would now be required to question medium-term scope for additional upside.

.png)

Boeing is the ETF’s largest constituent as well as being the biggest weighting in the Dow Jones Industrials Average. The share is still quite overextended relative to the trend mean as it tests its peak and a further pause appears likely before a move to significant new highs can be sustained.