Yellen Still Sees Significant Under-Use of Labor Resources

This article by Craig Torres and Jeff Kearns for Bloomberg may be of interest to subscribers. Here is a section:

Yellen has said the central bank has no “mechanical answer” for when to raise rates, and that before doing so policy makers must be certain the economy is on a solid footing.

?Most Fed officials forecast they will need to raise the benchmark rate sometime next year after holding it near zero since December 2008. The median estimate of policy makers released after their June meeting shows they project a rise to 1.13 percent at the end of 2015 and to 2.5 percent a year later.

FOMC participants will release their next set of quarterly projections on growth, employment, inflation and the rate outlook after the next meeting Sept. 16-17, which will also be followed by a Yellen press conference.

After expending a great deal of political, economic, monetary and emotional capital in its attempts to avoid a depression, the Fed appears unwilling to do anything that might jeopardise that objective. Waiting for certainty in statistics that lag by definition ensures the central bank will fall behind the curve in terms of managing price expectations, not least when wages eventually begin to rise on a widespread basis.

A debate continues to rage in the bond markets about whether the Fed will be able to raise interest rates at the end of next year. This runs along the lines that the scale of QE will be impossible to unwind, that the slack in labour market participation is structural and that low inflation means there is no need to raise interest rates. The 30-year Treasury issued late last year is up 14% this year and remains in a relatively consistent uptrend in nominal terms. Since this is the case, bond bulls are under no pressure from profit erosion just yet and last year’s decline has been largely unwound.

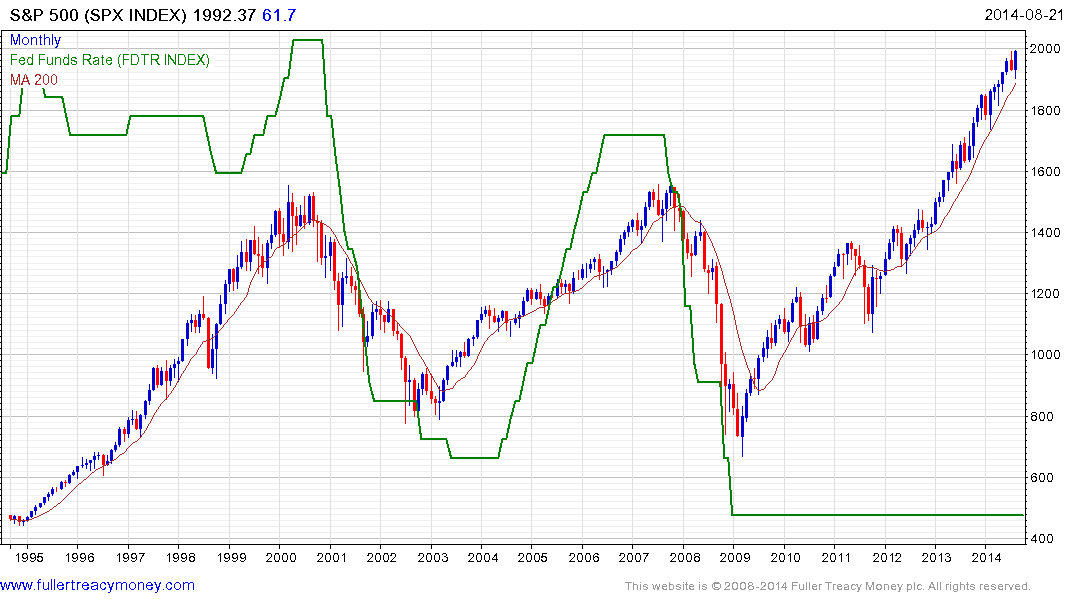

In the early 2000s the Fed was accused of being behind the curve in raising interest rates as housing, commodities, emerging markets and the US economy took off. This overlay chart of the S&P 500 with the Fed Funds Rate highlights how much interest rates fell and the interval between when rates began to recovery and the performance of the stock market. Obviously, the impact of the credit crisis and housing crash were much greater than the Tech Bust but the effect on asset prices from lax interest rates has also been outsized by design.

Media focus of late has been on the prospect of a surprise interest rate rise in the event that inflation surprises to the upside. For a moment let us consider another alternative, what if the Fed doesn’t raise interest rates for at least another year. Valuations are already pricey. Could they be running the risk of inflating a bubble in one or another sector? Quite possibly. This would be manifested in an acceleration of the medium-term uptrends from current levels so the ability or otherwise of the S&P 500 to extend its rally through 2000 will be instructive.

.png)