Zinc Breaks Through $3,000 Barrier as Metals Rally Gathers Pace

This article by Mark Burton and Winnie Zhu for Bloomberg may be of interest to subscribers. Here is a section:

Zinc surged above $3,000 a metric ton amid persistent global deficits, and aluminum climbed as China reined in illegal capacity, adding fresh impetus to the rally even as some investors expressed concerns.

Zinc jumped as much as 2.6 percent to $3,037 a ton on the London Metal Exchange, the highest level since 2007, and traded at $3,029 at 1:20 p.m. in London. Aluminum gained as much as 1.3 percent to $2,075.50 a ton, the highest since November 2014, while nickel, copper and lead all traded higher.

An index of base metals rallied to a two-year high last week amid better-than-expected demand in China and a weakening dollar. The Chinese government is stepping up moves to shut illegal aluminum and steel plants this year, both to cut excess capacity and help to protect the environment.

Efforts to promote economic growth in China ahead of a leadership reshuffle scheduled for later this year are also boosting metals usage in manufacturing and industrial sectors, according to Bernard Dahdah, a metals analyst at Natixis SA in London.

“Earlier this year, a lot of the rally was supply related, but recently we’ve seen demand starting to support as well,” Dahdah said by phone.

Synchronised global economic expansion, evident for the first time since the financial crisis, tends to boost demand for basic commodities. This is particularly evident in the industrial resources sector because it went through such a painful rationalization where expansion plans were cancelled, administrative staff fired and expenditures cut to the bone. That has resulted in an industry less inclined to increase supply in response to high prices.

Zinc had been forming a first step above a seven-year base but is now breaking out to new recovery highs. Provided the breakout is sustained recovery potential can be given the benefit of the doubt.

Copper remains the sector leader and completed a seven-month first step above its Type-2 bottom in July. A sustained move below $2.75 would be required to question medium-term recovery potential.

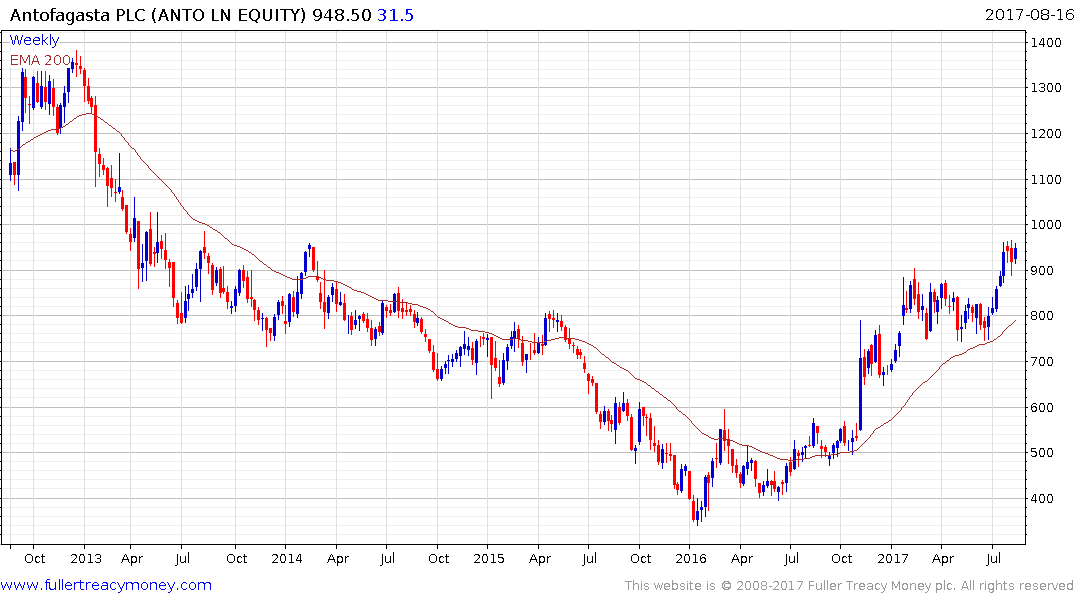

Antofagasta has been among the best performing shares in the FTSE-350 Mining Index this year; offering a high beta play on copper.

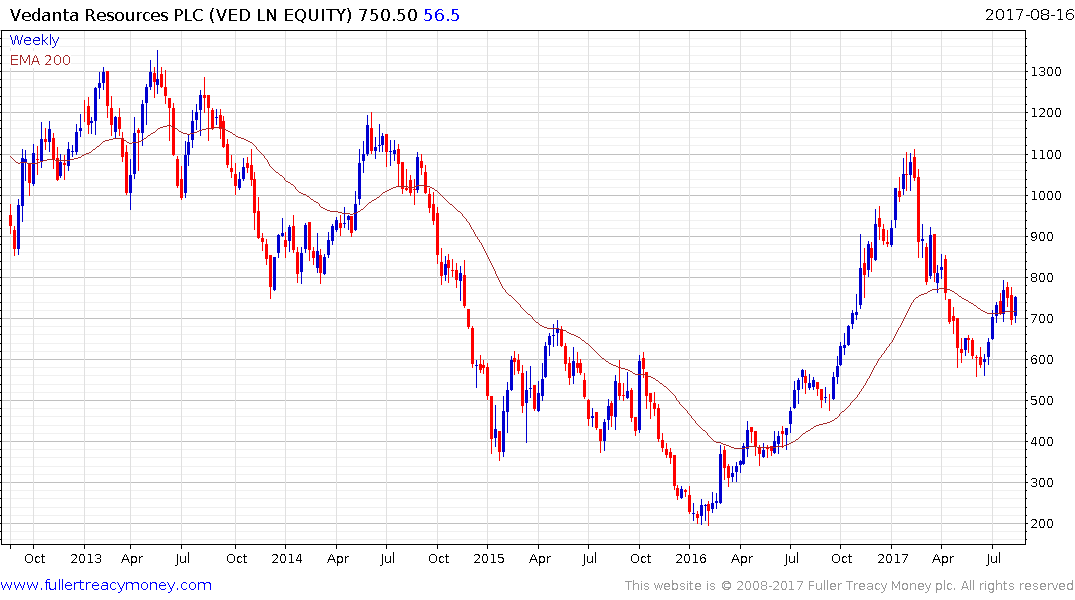

Vedanta on the other hand has been among the worst performers but is currently firming from the region of the trend mean and a sustained move below it would be required to question recovery potential.